Top 10 Mistakes to Avoid When Closing a Commercial Real Estate Deal

Selling commercial real estate is largely different from the sales of residential properties. The former includes a highly competitive market containing discerning buyers. Hence, as a seller, you must be ready to invest optimal efforts to win the best buyer to your side.

This can be as emotional and challenging as possible. As a commercial real estate property owner looking to sell your property, you are somewhat vulnerable to making certain mistakes that might get you confused about how best to close your commercial real estate deals.

This article comprehensively explores a practical guide to commercial real estate transactions, helping you identify top mistakes to avoid during the commercial real estate transaction processes.

Typically, proactiveness will help you land multiple potential buyers interested in buying your commercial property. Therefore, ensure you create a smooth commercial real estate deal structure, helping you close the perfect commercial real estate deals. One major way to do this is learning from these common “costly” mistakes.

Top 8 Costly Mistakes People Make When Selling Commercial Property

Undoubtedly, you must be considerably cautious when selling a commercial property, as you may lose several million because of mistakes. Continue reading to learn the mistakes many sellers commonly make and learn proactive ways to avoid them:

1. Wrong Pricing

Pricing is a major factor sellers must consider when putting their commercial properties out for sale. You must be intentional about the price you set for your commercial real estate, ensuring you aren’t either selling it too low or too high.

The major issue in this regard is understanding the actual worth of your commercial property, especially with the rapidly fluctuating nature of prices nowadays. Nonetheless, while overpricing can be unfavorable to you, restricting the willingness of buyers to buy your property, underpricing is yet another web most sellers need to avoid.

Offering your commercial property at an incredibly low price might scare credible buyers off, putting such a property in a bad light. We have seen this happen over time. However, understanding the art of selling can help you attract more customers using a lower price.

Regardless, ensure you aren’t underpricing your property. Sometimes, buyers may think there is something amiss with such a deal that you aren’t divulging, etc. It all boils down to understanding the market and determining the actual value of your commercial real estate. Finding the perfect selling price is a major step to closing a perfect commercial real estate deal.

2. Selling with the Wrong Agent

We advise you use an agent when looking to sell your commercial real estate property. Agents offer numerous advantages throughout the commercial real estate transaction process, including helping you handle the required paperwork, identify what potential buyers seek, oversee your pricing, etc.

However, selling using the wrong agent can be optimally consequential. Hence, ensure you choose the right agent for your commercial property sales!

Ensure the person you choose has appreciable knowledge about the local market, plus ample experience in closing commercial real estate deals, particularly in your neighborhood. You can find great agents via referrals, reviews, etc.

3. Negotiating for The Wrong Things

Your negotiating power is a crucial factor to consider during any commercial real estate transaction. How good you are at negotiating influences the type of deal you will close.

Being emotional is detrimental while negotiating. Often, it makes you focus on the wrong things. Hence, ensure you keep a professional atmosphere throughout the commercial real estate transaction process, as it might be hard to negotiate rightly with buyers when you still love your property. Be realistic with your negotiations, too.

4. Not Doing an Inspection

Inspection is essential. It lets you identify required repairs, updates, and any potential issues. It’s an excellent way to stay one step ahead of your prospective buyers. Failure to inspect your commercial property before putting it out for sale, apart from putting such property in a bad light, will also make it difficult for you to determine the property’s exact value.

You can hire a professional inspector to handle the inspection process for you, and you might choose to handle the process yourself if you are confident in spotting issues. Not inspecting your commercial real estate before listing might throw you under the bus, causing you to lose control over the pricing and negotiation process.

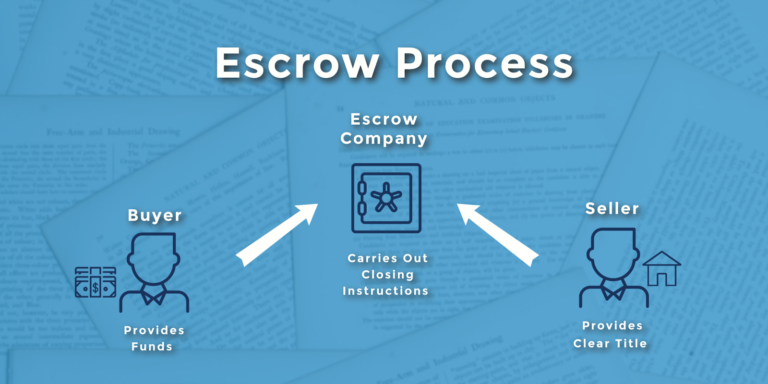

5. Using the Wrong Escrow or Title Officer

Escrow involves a neutral third party that holds funds until both buyer and seller involved in a commercial real estate deal meet a pre-defined agreement. It’s some sort of financial protection during property sales. In essence, nobody received title to a property or gets paid until both seller and buyer have fulfilled their agreed conditions.

Source, New Venture Escrow

Using the wrong escrow is as good as not using escrow at all, which exposes you to maximum risks, including losing ownership of your commercial real estate.

6. Not doing your proper due diligence and looking through all documentation

The main reason you must do proper diligence before selling your commercial property is to ensure a thorough inspection of your property’s fundamentals, financing, and compliance to certain requirements.

It’s inadvisable to rush into the commercial real estate transaction process, regardless of the situation, including negotiating advantage, especially if you are looking to close your first commercial real estate deal.

Thoroughly and adequately executed due diligence serves as risk proof, positioning you to record short-term success and long-term profitability in your commercial property deals. Otherwise, your risk might skyrocket, putting you in a disadvantageous position.

Also, do not sideline your documentations. They are as important as the entire sales process! Prepare your paperwork as carefully as possible, paying rapt attention to potential problems, including legislation.

7. Not Getting a Full Title Report

Ensure you resolve all issues with the commercial property’s title in the pre-planning stage. A full, clear title shows that your property is free from liens, claims, and other legal questions about ownership.

Your potential buyer will most likely order a title search; hence, you must ensure you have conducted a preliminary title search to identify and resolve any legal issues before the sale. This also stems from doing due diligence. Some commercial real estate property owners hire title clearing companies to handle this process for them.

Interestingly, you cannot be “too” sure of your property’s legal status, especially if you have been the owner for a long period. Certain title problems might have arisen in the background without your knowledge. And this also applies if you share ownership of the commercial property with other persons.

It’s challenging to monitor a property with shared ownership, as you might not know the financial obligations leveraged with such a property. Issues such as unpaid utilities, mechanic liens, secondary loans, etc., might have hampered the property title without your knowledge.

Hence, ensure you get a full title report of your commercial real estate property before putting it out for sales in other to close a favorable commercial real estate deal!

8. Not Using Escrow

Newbie commercial real estate property sellers must understand the importance of escrows and their role in protecting you against property loss.

Commercial property sales typically involve a larger amount of money, plus a somewhat complex process; hence, escrows help establish a properly controlled, formal environment, ensuring criminality is grossly avoided. Deciding not to use an escrow service is an intentional act of setting yourself up for doom.

Many unsuspecting commercial real estate owners make this mistake – you shouldn’t! Protect yourself from liability using an accredited escrow. As discussed earlier, using the wrong escrow is tantamount to not using any, if not worse.

Therefore, ensure you use an impartial third-party escrow that will protect funds and property, ensuring both parties – seller and buyer – fulfil their required obligations.

Other Mistakes You Should Avoid:

-

Leaving Your Commercial Property in Poor Condition

The importance of ensuring your property is in its best possible condition cannot be exaggerated. Buyers are typically judgmental when perusing properties; hence, you must ensure your commercial real estate property meets their standards by upgrading the condition of such property.

A slightly renovated commercial real estate has proven to have the edge over a shabby-looking one. The idea is that buyers aren’t open to lavishing their money on renovations done by a seller. However, you can take advantage of this realization to better the outlook of your commercial property while adjusting its price to suit its updated value.

This way, you are positioned to earn more from closing the deal while offering the potential buyer the maximum possible value of your property. It’s simple logic!

So, before you begin any commercial real estate transaction process, ensure the property is appropriately prepared from outside to inside, ensuring even the tiniest problems have been catered to.

-

Offering Your Commercial Property Poor Exposure

Another reason you might be struggling to close your commercial real estate deals is not giving your commercial properties the right amount of exposure. Technically, the wider the reach, the higher your chances of closing a perfect sales deal as quickly as possible.

So, you need to market your commercial property aggressively. Many commercial property owners believe a “for sale” signpost on their property is all they need to attract the right buyer. NO. You need more. It takes an intentional marketing effort to reach the best buyer possible.

Unfortunately, several commercial real estate property owners don’t have the luxury of time, inclination, or knowledge to invest in such a level of advertisement.

Hence, we advise you to hire reputable real estate brokers to help you through the process efficiently. Real estate brokers are experts at helping property owners reach the right audience, sealing the most deserving commercial real estate deal possible.

-

Lack of Organization

Ensure you are adequately prepared and organized before you put your commercial property out for sale. Have every required paperwork, including your tax reports, etc. Sometimes, an improper organization can restrict you from closing the best possible deal. Have a plan, and ensure you follow it through until you close the deal!

-

Zero Care for Your Clients

Undoubtedly, the residential real estate market is relatively different from commercial’s. However, how both markets operate are somewhat similar. Showing optimal care for your potential buyer is the right foot forward to closing an optimally profitable commercial real estate deal. Let your clients understand you have their best interest in mind.

-

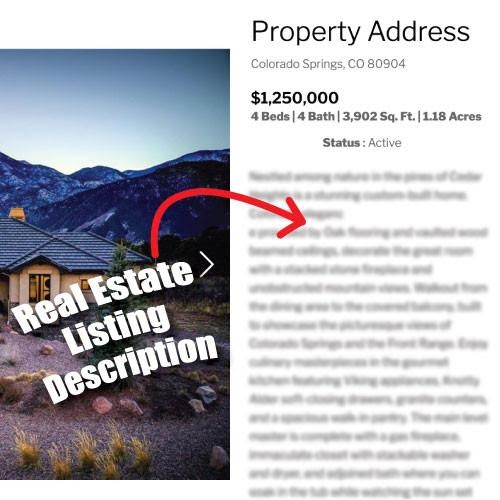

Improper Property Listing

This is also a facet of advertising and marketing your property. When and where you post your commercial real estate property matters. You can explore online publications, local magazines, and newspapers, etc., to let more people know about your plans to sell your commercial real estate.

Source, Great Colorado Homes

It’s all about intensifying your advertisement for the property. As mentioned earlier, the more effective your marketing strategy is, the better your chances of finding an interested buyer.

-

Disregarding Closing Costs

Another mistake you should note when selling your commercial real estate property is not considering closing costs. Overall closing costs depend on various factors, including commissions, title insurance, transfer tax, property taxes, escrow fees, advertisement costs, and others.

There are no fixed values for property closing costs; it largely depends on the commercial real estate deal structure and can be as high as 10% of your property’s selling price.

Final Thoughts

Selling your commercial real estate can be as tasking as possible, especially if you do not know common mistakes to look out for. You must know the appropriate steps to take, plus the most crucial ones to avoid throughout the commercial real estate transaction process to fully maximize your property’s sale potential. The due diligence checklists for commercial real estate transactions outlined in this article will help you close commercial real estate deals as quickly and favorable as possible.

Are you planning to sell your commercial real estate? Consult with Us at Commercial Consult

Commercial real estate deals feature several legal aspects, alongside other technicalities that might get you confused. Enjoy a seamless and effortless commercial real estate transaction process by speaking with our experts at Commercial Consult. Contact Us today.

3100

Bristol

St., Suite 150,

3100

Bristol

St., Suite 150, info@commercialconsult.com

info@commercialconsult.com