How to Sell Commercial Real Estate With Tenants Still Occupying It

What Is Commercial Real Estate (CRE)?

Commercial property is property used exclusively to do business or provide workspaces instead of a residence instead of residential real estate. A majority of commercial real estate is leased out to tenants for income-producing purposes. There is a wide range of real estate in this category, from a single store to huge shopping centers.

Source: Brikk App

Among the commercial property types available are retail stores, office space, hotels & resorts, restaurants, strip malls, and healthcare facilities.

Understanding Commercial Real Estate

Commercial real estate and residential real estate are two most common types of property. Residential property is a structure reserved for human habitation, while a commercial or industrial property serves for business or large scale residential use. In its name, commercial real estate is used for commerce, and multi-unit rental properties that tenants use as residences can be described as a commercial activity for their landlords.

Commercial property typically falls into one of four categories, depending on its purpose:

- multi-family rental;

- industrial use;

- office space; and

- retail.

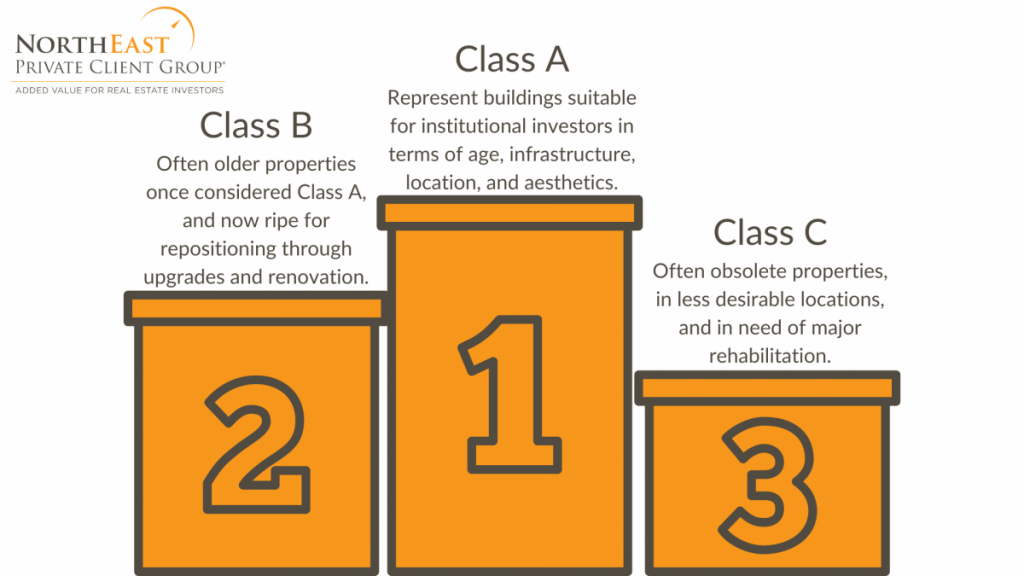

There is also the possibility of categorizing individual categories. For example, a common way to categorize office space is class A, class B, or class C.

- Class A properties are characterized by aesthetics, age, infrastructure quality, and location.

- A Class B building is usually older and does not compete as well as a Class A building in terms of price. This type of building is often targeted for restoration.

- A Class C building is typically older, situated in a less attractive area, and requires maintenance.

Source: North East PCG

In some jurisdictions, industrial properties are further divided into manufacturing and production sites, particularly heavy-goods sites, but most consider them a subset of commercial properties.

Managing Commercial Real Estate

To own and maintain leased commercial property, the owner must provide full and ongoing management. A commercial real estate management firm can assist property owners with finding, managing, and retaining tenants, overseeing leases and financing options; and managing property maintenance and marketing. A commercial property management company is essential since the rules and regulations governing such properties are different according to the state, county, municipality, industry, and size.

There is often a balance between maximizing rents and minimizing vacancies and tenant turnover for the landlord. For example, when tenants move into a newly built property that a yoga studio previously used, landlords can experience high costs because space needs to be adapted to accommodate the needs of new tenants.

Investing in Commercial Real Estate

Investments are assets or items acquired to generate income or appreciation. Over time, an asset’s value increases as a result of appreciation. As an individual invests in a good, he or she expects to use the good in the future to build wealth.

An investment is always an outlay of resources today — such as time, effort, money, or an asset — in hopes of a greater reward in the future than what was put into it.

An investor may, for example, purchase an asset now with the idea that the asset will be able to provide income in the future, or one that can be resold at a profit in the future.

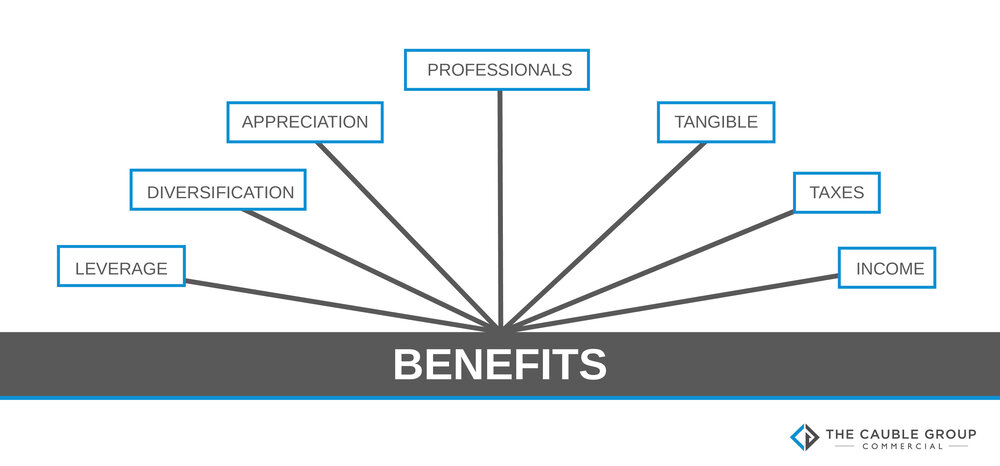

You can make a good living from commercial real estate and protect yourself from the stock market’s volatility by investing in it. Real estate investments can result in profits through appreciation when the property is sold, but returns are typically generated by tenants paying rent.

Source: The Investor Brook

Direct Investment

Direct investment is when the owner of the physical property becomes the landlord. It is best for people who understand commercial real estate to make direct investments or hire firms with such knowledge. It is risky and rewarding to invest in commercial properties. As CRE investments require a large amount of capital, such investors will likely be wealthy individuals.

An ideal property is located in an area with a low supply of CREs( commercial real estate) and high demand, giving favorable rental rates. Additionally, the local economy of the region influences the price of CRE purchases.

Indirect Investment

Investors can invest in the commercial market indirectly by owning investment instruments such as Real Estate Investment Trusts (REITs) and exchange-traded funds that invest in commercial property-related stocks. They can also invest in companies that serve the commercial real estate market, like banks and realtors.

Advantages of Commercial Real Estate( using California as a case study)

Commercial real estate California offers competitive lease rates, which is one of its biggest advantages. As a result, commercial real estate can provide significant monthly cash flows and impressive returns in areas where new construction is restricted or prohibited by law. Rents for industrial buildings are usually lower than office buildings, but overhead costs are also lower.

Source: The Caudle Group

Rent contracts for commercial properties are also typically longer than those for residential properties. When a commercial building is occupied with long-term tenants, this long lease length offers considerable cash flow stability to the real estate holder.

As long as the property is well-maintained and kept up-to-date, commercial real estate also provides a stable, rich source of income and capital appreciation potential. Additionally, it is a distinct asset class that can provide a portfolio with a means of diversification.

Disadvantages of Commercial Real Estate

The rules and regulations generally deter people who are considering investing in commercial real estate California directly. Commercial properties come with a lot of legalese covering taxes, procurement mechanics, and maintenance obligations. These requirements differ depending on many factors, including state, county, industry, size, and zoning. The majority of commercial real estate California investors have either specialized knowledge or employee payroll.

A second obstacle is the increased risk of tenant turnover, particularly in an economy where retail closures can occur abruptly, leaving properties vacant without much warning.

Residences typically require the same type of facilities as the tenants who occupied them earlier or will do so in the future. If an apartment building is rented out, each tenant may have very different requirements that require costly refurbishing. The building owner then accommodates each tenant’s trade. In commercial properties with high turnover but low vacancies, costs associated with renovations for incoming tenants can still be high.

Commercial properties tend to be more expensive than residential properties for investors seeking direct investment. Furthermore, while commercial properties are generally among the least liquid of asset classes, they tend to move especially slowly compared with residential properties.

Pros

- Capital appreciation potential

- High-yielding source of income

- Stable cash flows from long-term tenants

- Hedge against stock market

Cons

- Illiquid asset

- Greater regulation

- More capital required to invest directly

- Higher renovation costs

What’s the Possibility of Selling a Property with Tenants?

It is possible to generate a steady income from rent payments and property value appreciation by owning a rental property. Fortunately, the housing market is currently in a great situation. We’re witnessing increasing prices for rent in many major cities as many property owners decide to buy more rental properties.

Even when the market is thriving, there may be several reasons for selling a property with tenants, such as a relocation, a better investment opportunity, or an inability to handle the property.

There are complexities and considerations involved in selling a rental property e.g. ensuring you don’t break the commercial property tenant rights, but this is especially true when it’s a rental property with tenants living there. You probably have a lot of questions if you’re considering selling a property with tenants. First and foremost, do you have to wait until the tenants’ lease ends and have them vacate the property before you sell? Or can you list the house while they are still residing there?

To help you gather all the information you need, several opinions from several top professionals in commercial real estate.

Different Types of Rental Situations

Among his many real estate investments, Erik Jacobs is a landlordpartner with Cicero, France & Alexander, P.C. According to Jacobs, between 90% and 95% of the commercial transactions he handles involve tenants who remain at their properties.

Choosing the right rental agreement between you and your tenants is crucial. According to Brian Phan, owner of Sure Closing, a direct cash house-buying company in Atlanta, Georgia, there are two types of real estate investing:

Month-to-month Agreements

You have to learn how to tell your tenant in your residential property you are selling. Informing your tenant beforehand helps them to understand the intricacies of the situation and help in the transition.

Usually, your tenant should receive a “notify tenant of sale of property” letter at least 30 days before they’re due to move out, telling them what the due date is, says Phan. “You don’t need a reason to cancel a month-to-month contract, which is how ‘no-cause terminations are termed. One of the perks of a month-to-month agreement is that it allows you to pay only for the number of days remaining.” This is also in compliance with the commercial property tenant rights.

There are different notice requirements in different states, so make sure to check the regulations in your state before signing.

Fixed-term Leases

Choosing the right location for your tenants becomes more complicated when they have signed a fixed-term lease if a change in property ownership with a fixed-term lease requires more time and effort to sell the property.

Options for Handling Tenants with a Fixed-term Lease

Although longer-term leases are harder to break, you have to learn how to tell your tenant you are selling. You can do this by sending them a “notify tenant of sale of property” letterYou have to know what options are available to you. With his company’s partners, Phan has purchased more than 500 properties together, which he breaks down as follows:

1. Wait Until the Lease Expires

The plan explains that the easiest way to end a fixed-term lease is simply following the contract terms and waiting until the lease expires and your tenant moves out. However, he adds that if your tenant violates the lease terms, you will be able to terminate the lease easier if you provide proper notice.

Lease terminations can be justified for many reasons, including but not limited to:

- Defaulting on a lease

- The property is used for illegal activities

- Breaking a clause prohibiting pets

- A prohibition on subletting.

- Property damage caused by severe weather

- Getting in the way of others

- Fraudulently providing information on the rental application

When a rental property has been vacated, there are several benefits to listing it. For example, in Huntington Beach, one of the top-selling agents, Cheryl Coleman, says the value of a house will depend on its rental income. So you might be able to raise the rent when the tenants move out, which would increase the property’s value.

You can also renovate, repair, or upgrade a vacant property without disturbing the tenants, and staging, preparation, and shows will be easier, too, Coleman says.

The upside is we usually sell for at least 20% more than we would if we had sold with the tenants still living there, she says. So besides losing two to three months of rent, it’s a surefire way of getting a higher sale price.

2. Sell the Property to an Investor with an Active lease

A fixed-term lease does not automatically terminate when the property is sold or transferred. Almost every state requires the lease and security deposit to be transferred with the property so that the new owner becomes the new landlord.

A property that is occupied and has a lease restricts the number of buyers since you must sell to someone who will accept and understand that the property is occupied.

Phan says that selling to an investor would be the best option in this scenario, as the new owner would need to rent the apartment to the tenant until the lease expires.

Jacobs points out that a tenant’s existence can be a major selling point when it comes to commercial leases. In addition to looking at the return on their investment, investors are also more likely to look at the price they are paying for the home. Net operating income (NOI) is a key part of their investment decision. An investor looks for tenants with solid financials. The majority of landlords would love to have a tenant who has been renting for over a decade.”

3. Offer “cash for keys”

Consider negotiating a settlement with the tenant to get them to leave home before the lease expires if you have a qualified buyer ready to buy the property. This strategy is also known as “cash for keys,” It can be quite effective, but it can also be quite costly.

Here are Phan’s tips for determining how much to offer if you choose to pursue this route:

- Adjust the rent according to the area: “Look at what comparable properties rent for in the area.” Phan advises offering to cover the difference between what your tenant will likely have to pay and what they have been paying you, multiplied by the remaining lease term.

- Cover moving costs: As a gesture of appreciation for the inconvenience of the early relocation, you might want to contribute some money towards moving expenses.

- Provide a security deposit: Phan suggests giving your tenant half of what they would need to move into a new place, which is usually a month’s rent plus the security deposit.

- Whatever you can afford is the amount you should offer: Your final decision will depend on your available financial resources and what you stand to gain from getting your tenant out early.

You are under no obligation to accept the tenant’s offer or have them accept any terms you offer. Moreover, if the lease is not renewed, you’re back to square one and have to sell the property at the end of the lease.

4. Sell the Property to your Tenant

If you are selling a property with tenants , you can sell it to your current tenant, who will already be familiar with the property’s features. You could also offer seller financing as a way to sweeten the deal, which is a kind of arrangement where you step behind the lender’s desk, and your tenant makes short-term payments toward the purchase price. This way you can avoid infringing on the commercial property tenant rights.

“Seller financing is often only attractive to tenants who have been with the property for years.” says Phan. In addition, many sellers do not offer seller-financed deals unless they have established ownership of the property outright or received approval from their mortgage lender.

You might allow the tenant to arrange their financing for the purchase if seller financing isn’t a viable option.

This will, however, only be possible if you have learnt how to tell your tenant you are selling

5. Execute an Early Termination Clause in the Lease

Phan describes how some lease contracts contain a “safety net” for landlords in the form of an “early termination clause,” which can be triggered in several ways.

There is a probability that tenants with good standing may not live out their entire lease. Therefore, some leases include a clause for early termination, which you can use in a wide range of circumstances.

These clauses typically state that the lease will end after closing on the sale of the property, for example, in 30, 60, or 90 days. If it is reasonable and both parties agree in the lease, you can choose what the “trigger” is for your lease termination.”

The Keys to a Smooth Sale with Tenants

Maintain communication with tenants when selling a property. They need to know what to expect. Here are some ways Phan suggests they keep informed and prevent unpleasant surprises:

Source: Nimble

Know the Laws

Regarding tenants’ rights, each state may have different laws, so get in touch with an experienced property manager, attorney, and real estate agent who is familiar with the local regulations.

Be Upfront about Selling

Get in touch with your tenants and let them know how you intend to try selling a property with tenants, as well as any potential impact it might have.

Phan advises explaining the process for showing the house, but shows that you understand the inconvenience it may cause and that you will do whatever you can to minimize disruption. When you show tenants such care and concern, they will trust you more easily, which will make the transaction go smoothly.

Schedule Showings as Conveniently as Possible

Your tenants should be able to choose the days and times they would prefer to have viewings. Residents appreciate getting at least 24 hours’ notice when you schedule showings, as that shows respect for them and their space.

A real estate agent cannot just show up and enter a property without an appointment, Phan says. If they are entering the property, they must give advance notice according to the laws of your state.”

Don’t Put Signage in the Yard Alerting Neighbors and the General Public

Phan warns people not to think of this as a chance to find out more about the house by knocking on the door. Instead, he suggests your tenants warn you that they should never let outsiders into their property. To ensure safety and to learn about best practices, they must always refer to the agent.

Communicate after the Sale

Following the closing of a property, Jacobs typically drafts a letter that states that the tenant should send their next rent payment to the new landlord and is signed by the seller.

In many cases, the seller meets the buyer at the property and introduces them to the tenants, Jacobs says. “I consider this form of marketing most effective.”

The real estate agent has also served as the property manager for sale that he has overseen. If that is the case, the agent stays in the role, and the owner moves behind the scenes.

“Tenants paying the same management company after closing won’t notice any difference,” Jacobs says.

Advantages of Selling Commercial Real Estate with Tenants Still Occupying It

In some cases, commercial agents advise landlords that the lease must end before you can sell the property if that period lies within the next 3-6 months. Although this makes their lives easier, they do not have to schedule appointments with tenants to show the property to prospective buyers.

In contrast, commercial properties with tenants are viewed as so much more than just buildings – they are real business models. Therefore, having a going concern is what makes an investment presentation in the commercial property market successful.

Average Lease Length

The length of time tenants stay at a commercial property is intrinsically linked to the number of tenants living there. Therefore, it is common for serviced office spaces to offer short-term lease agreements, with some companies taking occupancy for just six months.

The figures above demonstrate that this is not necessarily a problem if many tenants regularly move in. However, for real stability, invest in commercial properties with tenants who have signed leases for five years or more to show true stability.

Leases with a longer term usually include break clauses. What percentage of tenants left at the point of the break clause throughout the lease, how many remained until the end of their lease, and, most importantly, how many extended their lease?

In our example, we will use the average lease length of tenants in the commercial building by adding together these figures and dividing accordingly. It is more attractive to invest in a property with fewer tenants and a long lease term than one with plenty of tenants and a high attrition rate.

Commercial investors who don’t wish to take on the responsibilities of a landlord especially need this expertise. It’s not their intention to constantly be marketing their property and showing it to potential tenants. While they can easily hire a commercial agent to do this for them, such continuous management will take a toll on their profits, making their commercial properties and business a less attractive proposition overall.

Current Income

Despite their importance, forecasted figures are never as concrete as actual numbers. An important part of selling a commercial property can demonstrate the income derived from the rental property.

A tenant’s current lease agreement is binding upon the new landlord when a commercial property is sold with tenants in situ. Because of this, the buyer cannot simply buy the property and increase the rental immediately. It is entirely within their rights to increase the rent after the current leases expire. However, that can be regarded as a risk.

Tenants have the option of finding alternative accommodations for their businesses, which adds to the problem. As a result, the commercial property owners start with either a smaller profit margin or a loss as they lose the rental income of that tenant.

Second, it will be necessary to engage in marketing activities to find and acquire new tenants. Aside from appointing agents and advertising, discussing the sale with solicitors, negotiating, and so on, you must spend time on these tasks.

Furthermore, the word can spread locally about the building’s unreasonable rent rates, making it extremely difficult to find a new tenant.

The following is meant as a guide for the sale of a rental property that has tenants. Unfortunately, this is not an ideal situation.

Looking at this issue from a more optimistic perspective, the current rental figures form the initial basis of a successful marketing campaign. Is “3000 square feet of office space available” more impressive than “80% of leases are for five years with 3000 square feet of office space currently generating £25,000 per month”?

Again, it’s important to emphasize sharing a mindset with fellow commercial property investors in your marketing. Generally speaking, real estate investment is a long-term strategy, with most investors expecting to get a return after at least ten years because of appreciation or a combination of both. It is not merely a matter of selling real estate when a commercial property is rented out; it is also a matter of selling a successful business. Therefore any marketing material should be as persuasive as possible.

Seek Cooperation from Tenants

It is the tenants of any commercial property who are the most effective advocates. New potential buyers will ask what they can expect from the building and its tenants if the building is being viewed.

Cons of Selling a Commercial Real Estate Property with Tenants

As a start, your buying options may be limited depending on what kind of property, what market, and what kind of tenant you are searching for. Renters’ lease types may be able to be searched by, but that, at the very least, adds to the prospecting effort.

If you purchase a commercial property with tenants, you may also have to adhere to existing leases, making filling the space more challenging.

Perhaps you are primarily interested in triple-net (NNN) properties. Therefore, in this situation, you won’t have a say in whether that’s true or not.

Most of the time, it’s about having less flexibility-you might have to accept lease terms you’d normally refuse.

The real power of Reonomy is that it allows you to search virtually any market nationwide for any commercial asset with any business tenant.

Commercial Consult

Our Commercial Consult team is available to answer any questions you might have about selling commercial property.

The professionals we represent are well-versed in the commercial real estate market and transactions related to it. We have a proven track record of delivering top-notch services with a lot of client reviews to prove it.

By partnering with us, we can help you maximize your profit on all commercial real estate transactions. Get in touch with us today!

3100

Bristol

St., Suite 150,

3100

Bristol

St., Suite 150, info@commercialconsult.com

info@commercialconsult.com