Ultimate Commercial Real Estate Glossary – Top 100 Terms You Need to Know

Do you find it challenging to understand commercial real estate terminologies?

Commercial real estate, which deals with property used for mainly business-related purposes, can be quite complex.

Do you find the terminologies used in commercial real estate too complicated?

We’ve prepared a comprehensive commercial real estate glossary containing 100 commercial real estate terms to know while buying and selling commercial property.

You need this glossary of commercial real estate terms to learn new terminology and make informed decisions. It is comprehensive with definitions that are easy to understand.

In this glossary, you’ll find commercial real estate lease terms, commercial real estate loan terms, commercial real estate finance terms, and other important commercial real estate terms and definitions.

Let’s get started!

Ultimate Commercial Real Estate Glossary and Resource

1. Absorption:

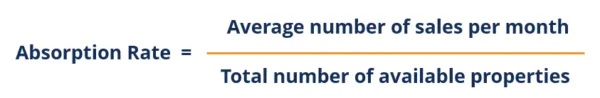

Often reported as a property’s absorption rate, an absorption is the amount of units or inventory of a particular type of commercial property that was occupied in a given market within a specified time period (usually not exceeding one year).

The rate at which an empty space is leased or purchased within a specified period of time is known as the absorption rate. It is often expressed in square feet per year for commercial property and units or homes per year for residential property.

(Source: Corporate Finance Institute)

2. Addendum:

An addendum in real estate is a piece of additional information covering certain circumstances of a transaction and it is often added to a form contract as an attachment before execution of the contract or during escrow. Meanwhile, the part of the contract that doesn’t need adjustment will remain the same irrespective of the addendum.

Examples of these circumstances include variables like requirements relative to property inspections, financial contingencies, among others. They often apply to properties with long legal descriptions. Some real estate contracts require two or more addenda.

3. Adjustable-Rate Mortgage (ARM):

ARM refers to an instrument that allows real property to be used as collateral for a promissory note, which must specify interest rates and how they are expected to change from time to time. An adjustable-rate mortgage comes with variable interest rates that are based on the outstanding balance of each period on the loan.

You may begin with very low monthly payments unlike what is required for a fixed-rate mortgage, but expect the monthly payments to rise in the future as a result of fluctuating interest rates.

When issuing an ARM, the three important features to consider are introductory rate, actual rate, and conversion option.

4. Amortization:

Amortization is a process of using regular payments or installments to pay off debts, for example, a mortgage, over an agreed period of time. It keeps track of the amount of money assigned to the principal and interest for each installment. Usually, it takes between 15 to 30 years. At the end of the agreed term, the loan should be paid in full so there is no balance left.

This progressive and gradual method that slowly eliminates loans can apply to capital investment or lending. However, not all loans are amortized completely.

5. Annual Percentage Rate (APR):

It refers to how much a loan costs annually, and may include interest rate, broker fees, points, and some other credit charges required from a borrower. The APR serves as an estimate to help make informed decisions before starting a loan repayment plan. Under the Truth in Lending regulations, the APR must be reported by lenders.

Also, the Annual Percentage Rate must include all charges not expected to come up in an all-cash transaction, such as charges paid to mortgage brokers and lenders. Examples include credit report fees, pest inspection fees, appraisal fees, as well as title insurance charges.

6. Appraisal:

An appraisal involves having an opinion about the value of something, like a house, stock, or jewelry. Such an opinion has to reflect the amount a buyer would willingly pay a seller with neither party under any pressure or duress.

It is often required before a real estate agent tries to market any financed property that differs from any property that is commonly sold in the marketplace. An appraisal must be carried out by an appraiser if a loan is placed on the property to ensure the bank is not lending too high an amount on the property.

During the appraisal process, the appraiser examines the property to estimate its current value after comparing its initial purchase price to recent prices of similar properties in the area.

7. Appraiser:

An appraiser is a professional whose duty is to conduct an analysis, also known as an appraisal, on a property with the aim of estimating its value. The analysis covers examples of sales involving similar properties. An appraiser must be licensed to conduct an appraisal of the real estate or personal property and often charges a fee.

A commercial real estate appraiser estimates the value of several types of commercial properties, such as land, office buildings, shopping centers, hotels, and industrial buildings. This estimation requires different levels of expertise but must be completed using any one of these approaches: the income approach, the sales comparison approach, or the cost approach.

8. Appreciation (APP):

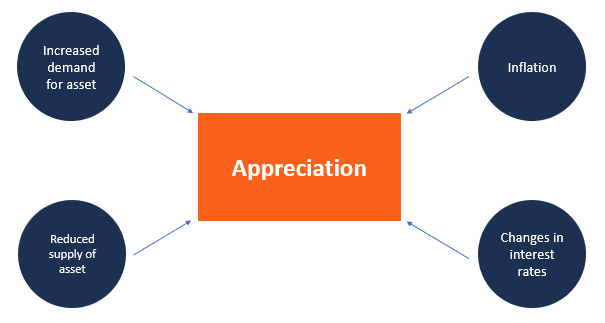

An appreciation is defined as an increase in a property’s market value or worth due to improvements or changing market conditions. Generally, real property is known to appreciate over time when properly maintained and repaired.

Some factors that can lead to an increase in a property’s value are inflation, economic growth of the area, increased demand for the property, population growth, changing interest rates, and lots more. Property appreciation occurs with almost any piece of real estate and under a wide variety of circumstances.

(Source: Corporate Finance Institute)

9. As Is:

A real estate term used to refer to a property that is in its present condition without the seller giving any guarantees. The term is used when a seller is selling a property in its current condition to a buyer, who is agreeing to purchase it with all its faults, including the faults that are not yet apparent.

The purpose of the clause is to let the buyer know that the seller does not intend to make any repairs or improvements to the property.

The “as-is” clause goes hand-in-hand with the “where-is” clause to ensure that the buyer has rights, and the seller is not absolved of all responsibilities.

10. Assessed Value:

It refers to the value an appraiser places on a property for taxation purposes. When calculating property taxes, fire district dues, school taxes, and other related charges, a tax appraiser has to determine the fair value of the real property in the market.

An assessed value is often calculated as a particular percentage of the appraised value, and this percentage varies depending on what the property is used for and any exemptions.

11. Assignment:

An assignment shows the transfer of mortgage ownership from one person (the assignor) to another (the assignee). It is often used when an investor signs a contract allowing him to purchase a property but still maintains control or ownership of said property and reserves the right to assign the contract to a future business entity.

More so, an assignment can be used when an investor desires to hide his or her identity when purchasing a property; this means the investor will need to employ a straw man who will sign the purchase contract before it is assigned to the main purchaser.

Another way an assignment is used is when a speculative purchaser of property that will be built in the future signs a purchase contract at a fixed price, expecting prices to increase dramatically upon completion of construction for the purpose of making a substantial profit by assigning their contract to another purchaser.

12. Assumable Mortgage:

An assumable mortgage is an existing mortgage loan that the buyer can take over or assume on the same terms the original borrower was given. This transaction involves a real property buyer taking over the existing mortgage of the seller.

However, the seller will still be liable unless the lender releases him or her from the obligation. A loan is not likely to be assumed without the consent of the lender if the mortgage includes a due-on-sale clause.

13. Automated Valuation Model (AVM):

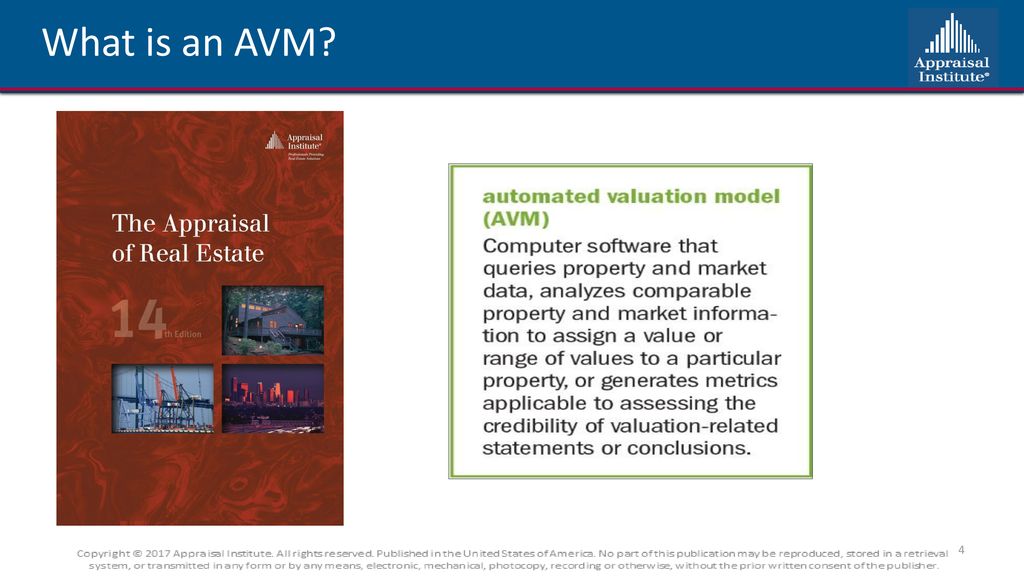

A process of estimating many property values efficiently, and often accurately by using a computerized method. Tax appraisers often use the AVM to periodically reappraise real properties because of taxes. If the valuation is not accurate, a property owner can decide to appeal it by showing evidence of the mistake the computer made.

(Source: Slideplayer)

With advancements in technology, AVM artificial intelligence is now used by lenders to appraise property for the purpose of mortgage loans. The IRS also uses this artificial intelligence to evaluate the assets of a taxpayer.

14. Balloon Mortgage:

A term used to describe a mortgage that comes with a final payment that is much more than the preceding payments. The monthly payments for the mortgage have an unpaid balance that is due after a specified period of time, usually in a lump sum payment.

The payments are usually based 0n an amortization schedule of 30 years but the principal balance could be due from 5 to 7 years. Sometimes the mortgage contains an option to extend the due date if specific conditions are met and to reset the interest rate to the current rate in the market.

15. Blockbusting:

Also referred to as panic peddling, blockbusting is an illegal practice whereby someone induces panic in another person or a neighborhood to make people sell or grant a listing contract.

In this discriminatory practice, the person trades on fears that the neighborhood is changing in terms of race, family status, religion, sex, color, ancestry, or disability. Fair Housing laws prohibit such housing discrimination by landlords, lenders, real estate agents, and homeowners’ insurance companies.

16. Bridge Loan:

A bridge loan, also called a “swing loan,” is a short-term loan that a borrower’s present home (often for sale) secures to bridge the gap between transactions by using the proceeds for building or closing a new house before the final sale of the present home.

This form of temporary financing is obtained at the completion of a construction loan period before arrangements can be made for permanent financing. Most times, such loans are offered by employers when they transfer employees to a new city.

17. Broker:

A real estate agent who stands as an intermediary between sellers and buyers of real estate property. As soon as a written offer is received, a real estate broker submits it to the principal immediately and is not allowed to hold any offer if awaiting a juicier one.

Moreover, the broker is not allowed to make contracts but owes the principal’s or client’s fiduciary responsibilities to carry out their duties in honesty, skill, integrity, and care.

18. Broker Price Opinion (BPO):

A BPO also referred to as a broker opinion of value (BOV), is often obtained by lenders who are based outside a state but want to sell a distressed property. Most states only authorize a licensed appraiser to give a professional opinion on a property’s value.

However, a real estate broker may offer an offering as to the asking price of a property that is about to go on the market. Different approaches such as sales comparison, income capitalization, or cost analysis may be used when creating a broker price opinion.

19. Buydown:

A buydown is a cash payment to a lender, meant to reduce a borrower’s interest rate, and it is often measured in points. It comes up in a situation where a person pays discount points to reduce the interest placed on a mortgage loan so as to buy down the rate.

In a buy down, additional points are paid on the loan in order to reduce the monthly mortgage. The property owner pays a lump sum into an escrow account to supplement the monthly payments of the debtor. This lump sum is often paid as a financial incentive to make their property more attractive for someone to purchase.

Borrowers do not need to buy down their rates when dealing with residential loans.

20. Cap Rate:

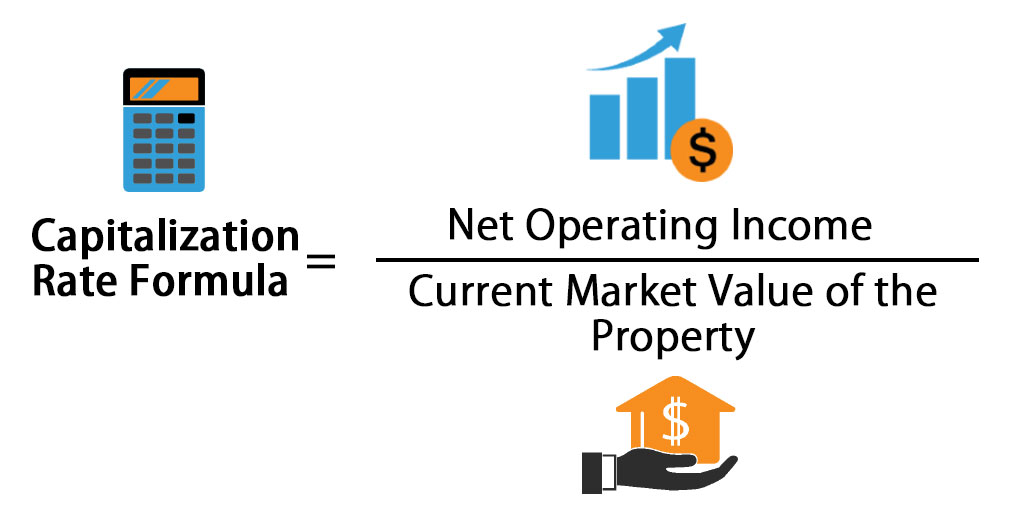

The cap for an adjustable-rate mortgage or loan is a limit placed on the amount that mortgage payments or interest rates may either increase or decrease. This maximum allowable increase or decrease is fixed for a specified amount of time.

In commercial real estate, the capitalization rate is a metric used in estimating the potential rate of return of the commercial property, especially if purchased with cash. It is calculated as the ratio of Net Operating Income to the property asset value.

(Source: EDUCBA)

Cap rate varies widely depending on tenant base, asset class, property type, and the real estate market. The cap rate most properties trade in falls within the range of 3% to 10%.

21. Cash-Out Refinance:

A transaction that creates a way for investors to benefit from their growing assets without selling them. This non-taxable event allows a property to be refinanced in an amount that can pay off existing debt while providing the owner with cash.

In this transaction, the borrower gets additional funds that far exceed the amount required to repay the existing mortgage, points, closing costs, and other subordinate liens.

Cash-out refinancing allows investors in commercial real estate to unlock the money that is stuck in an investment that has become illiquid. A cash-out refinancing deal can help to finance as much as 75% of a property’s LTV.

22. Chain of Title:

A history of all documents, from the earliest existing document to the most recent document, that have transferred title to an existing parcel of real property. In other words, it is a history of a property’s conveyances and encumbrances from a starting point, in which the current owner derives title.

This history of owners and lienholders of the real property contains the date of acquisition and the nature of the title. It covers who built the structure, who first owned it, who bought it, up to the present-day owner. If your rights to own property are ever questioned, the chain of title will come in handy to prove your ownership.

23. Clear Title:

Refers to a land title, good title, or other marketable titles with no liens, mortgages, defects, legal encumbrances, or adverse claimants against it.

A clear or clean title shows that you have acquired full ownership rights to real property without any type of claim or lien by creditors against the property.

A title search is important to determine if you can receive a clear title in a commercial real estate transaction. It is important to find and review documents on the history of the property’s ownership when conducting the title search.

24. Closing:

It is the conclusion of a sales transaction that occurs when a seller transfers title to a buyer in exchange for consideration. Such proceedings are often held at a title company.

A closing, which in essence, covers all processes involved in completing a financial transaction, requires that all necessary signatures be obtained, all required disclosures made, and all monies collected and disbursed before transferring title to real estate, and/or executing a mortgage.

The Real Estate Settlement and Procedures Act regulates closings. Closing is also called “escrow” in some jurisdictions.

25. Closing Costs:

These are costs, fees, or expenses a buyer has to pay when closing a sale or mortgage and may vary from one financial institution to the other.

The buyer has to pay these costs in addition to the down payment, which may include title charges, points, document preparation fee, credit report fee, mortgage insurance premium, appraisals, inspections, deed recording fee, insurance, prepayments for property taxes, escrow fees, cost of survey, listing agent’s commission, selling agent’s commission, transfer taxes, and other potential expenses.

The only exception is the lender fees and actual purchase price of the property. Instead of specifying that both the seller and buyer will share the closing costs equally, it is better to clearly state the allocation for payment and all anticipated expenses.

26. Co-Borrower:

A borrower, who isn’t the first borrower, but whose name is on both the application and mortgage note. It does not matter whether the person is a joint owner with the first borrower and also shares liability for the mortgage note. The income and the credit history of the co-borrower are used to qualify for the loan and all parties involved are also obliged to repay the loan.

A co-borrower becomes very useful when a debtor cannot qualify for a loan. Moreover, with multiple borrowers on a loan, the amount of principal credit that will be approved on the loan will also increase.

27. Commission:

A fee or compensation that is charged by and paid to a licensed real estate broker for services performed in connection with a lease, exchange, or sale of a property. It is often a percentage of the property’s selling price and can also be paid by the broker to a salesman in exchange for services rendered.

A real estate agent, for example, earns a fee on the sale of real property. However, a broker is only entitled to a commission if there is a licensed written contract for the services. The broker only earns the commission after producing a buyer who is ready and able to close based on the terms already specified in the written contract.

28. Common Area Maintenance (CAM):

Any space that two or more tenants commonly use without one tenant having exclusive access to the space is referred to as a “common area.” Maintaining the common area is the responsibility of the landlord or the property management company.

CAM covers costs needed for the pro-rata portion of a tenant’s upkeep of amenities and common areas, including parking lots, street cleaning, external lighting, and trash removal.

The fees for the maintenance of the common area are collected from the tenants and used to oversee the management of that space. However, landlords and tenants need to negotiate the charges before executing the lease.

29. Construction Loan:

A loan taken to provide payment for any construction work, improvements to a property, or development in a subdivision. The lender disburses the loan payments to the builder at regular intervals while the improvement, construction, or development is in progress.

Also called a self-built loan, this short-term loan, which typically lasts for a year, is riskier than conventional mortgage loans and incurs a higher interest rate. Most construction loans require full payment of the balance by the end of the project.

Many lenders demand a down payment of not less than 20% on a construction loan. National banks and local credit unions are known to provide construction loans.

30. Contingency:

A condition that the parties involved in a contract must meet before the contract becomes legally binding. This provision included in a contract states that some or all the contract’s terms will either be altered or voided if a specific event occurs.

(Source: Real Estate Skills)

No commercial real estate contract is complete without a few contingency plans in place as a safety measure for both the buyer and seller. Commercial property investors can benefit from having contingency plans as they help to mitigate lots of unnecessary risks.

It is important to decide on the contingencies that work best for your needs.

31. Conventional Mortgage:

A mortgage loan neither insured nor guaranteed by the federal government or any of its agencies, such as the U.S. Department of Veterans Affairs (VA), the Rural Housing Service (RHS), or the Federal Housing Administration (FHA).

The conventional loan is one of the financing options to consider when purchasing a commercial real estate building. Most people use a conventional mortgage when purchasing an investment property that is stabilized.

A credit union, bank, or other traditional financial institution provides this loan and will accept any form of commercial real estate as collateral. The timing for closing this loan ranges from 60 to 90 days after the term sheet has been issued.

32. Cost of Funds Index (COFI):

COFI is an index used in determining changes in interest rates for particular adjustable-rate mortgage loans. Also known as a yield index, it is based on the cost of funds to loan and savings institutions in the San Francisco Federal Home Loan Bank District.

COFI mortgages and loans have interest rates that fluctuate more slowly than variable-rate loans which are linked to other indices. Most professionals use this index to either adjust or change the interest rates on adjustable-rate mortgages (ARMs).

33. Covenant:

A restriction that governs the use of real estate, found in deeds or documents, binding every landowner in certain development. It could be a requirement that properties in a particular area be used for residential purposes only.

A person can write this restrictive agreement regarding real property usage into the real estate records and it will remain binding on all owners irrespective of whether it is included in their particular deed or not.

34. Debt-to-Income (DTI) Ratio:

The percentage of the gross monthly income used for paying installment debts like monthly housing expenses, car payments, alimony, and child support. It is also used to pay for open-ended accounts like credit cards.

Lenders use the DTI ratio to determine a person’s borrowing risk. A borrower with a low DTI ratio is considered to have a more sufficient income and is more likely to pay off debts on time.

A borrower with a DTI of 43% (the highest ratio) can still be qualified for a mortgage. However, most lenders prefer ratios not exceeding 36%.

35. Deed:

A written instrument or document that bears the description of a particular property to allow conveyance of the title for the property. It must be properly signed, acknowledged, and delivered.

A deed is a crucial part of a commercial property agreement. A commercial property deed must contain restrictions for how the property is used and upkeep, including rules for maintaining the property’s common areas.

The restrictions in a deed apply to even successive owners and tenants of the commercial property and can only be changed before renting or leasing the commercial space.

36. Deed-in-Lieu of Foreclosure:

A document or instrument that transfers a real property title to a mortgage lender without going through the process of foreclosure. Lenders find this procedure attractive because it is fast, lacks defenses, and eradicates the fear of last-minute borrower bankruptcy.

However, lenders face some risk if intervening liens are present. Borrowers also like it because it contains no foreclosure to credit records. If other liens were recorded after a deed of trust or mortgage, the foreclosure will destroy them.

37. Default:

The inability to meet certain legal obligations or perform certain duties on time. It includes failure to perform a non-monetary service or pay on a financial obligation.

Loan agreements, property agreements, and lease agreements are some of the types of contracts that include a default clause.

A default clause in a commercial lease agreement is included to allow the landlord to demand that their tenants comply with all the requirements of the agreement. It also explains how an eviction will be carried out if the tenant violates any rule of the agreement or defaults on their obligations.

38. Delinquency:

The failure to make payments at the scheduled due date. It is sometimes referred to as a loan that is past its due date by 30 days or more. A loan may accrue interests and some penalties if your mortgage becomes delinquent.

However, you may not necessarily lose your property simply because your mortgage is delinquent if you can make payments of any amount to stop a foreclosure while the loan is delinquent.

Delinquency is not so bad if you are aware of it. It even helps to avoid foreclosure.

39. Down Payment:

A percentage of the price of a real property that is not borrowed and often paid in cash. This amount of money, paid up-front by the buyer to the seller, is often the difference between the mortgage amount and the purchase price, usually ranging between 3 to 20 percent.

Providing a substantial down payment will help to reduce the monthly payments needed to complete the transaction, and also reduce the amount of interest to be paid over a long term. However, some loans do not require any down payments.

40. Due Diligence:

The due diligence process involves investigating the facts, rules, conditions, laws, financial considerations, regulations, and other related matters that are likely to affect a person’s decision to purchase real property.

Investigations vary from one property to another and could include a home inspection, review of restrictive covenants, and termite report – if related to the purchase of a home.

Investigations regarding the purchase of raw land for development may include possible environmental contamination, issues with zoning, soil compaction studies, surveys, analysis of developmental cost versus the value of the property upon completion, etc.

(Source: SlideShare)

41. Earnest Money:

It is a deposit, usually held by a title company in an escrow account, made by a buyer as evidence while offering to purchase a property and ensure the contract is secured. Earnest money is paid in the period between when the contract is accepted and when it is closed.

Basically, it shows that you are committed to purchasing the real estate property and can proceed to close. Also, it serves as a hostage value such that once the seller accepts the offer, it will not be refunded unless one or more contingencies of the sales contract is not fulfilled.

42. Easement:

It is a non-possessory right to use someone’s property without unduly burdening the property. It is usually created by prescription (unrestricted use of the property over a period of time, which could result in property rights), by necessity (when the law enforces grant of egress and ingress rights for a landlocked property), or by express words of grant (written in a document).

Property owners often grant easements for utility trenches, sewer lines, water lines, or utility poles to be placed on their property. Easements can be either appurtenant or gross.

43. Easements Appurtenant:

This is a type of easement that remains with the land irrespective of the owner or the number of times the property changes hands; for example, a right-of-way easement is also called a right to travel over someone’s land.

If an easement is an appurtenant, then it benefits one property (also referred to as the dominant estate, dominant hereditament, or dominant tenement) while burdening another (the property with the burden is often referred to as the servient estate, hereditament, or tenement).

44. Eminent Domain:

Sometimes referred to as expropriation, an eminent domain is the right or power of a government to use a court action (called condemnation) to retrieve a private property for public use – any use sanctioned by the legislative body at the federal or state level, such as roads, schools, parks, hospitals, reservoirs, etc.

The United States Constitution (Fifth Amendment) permits this action if the owner is justly compensated by being paid a fair market value for the property.

45. Encumbrance:

A burden, claim, limitation, or charge placed upon real property by a party who doesn’t own the property. In addition to a mortgage, an encumbrance may also include liens, covenants, licenses, encroachments, deed restrictions, unpaid taxes, and easements.

It is present in an abstract of title and can restrict the ability of an owner to transfer title to a property or reduce its value until the encumbrance is lifted. Not all encumbrances are financial and they can apply to personal property as well.

46. Equal Credit Opportunity Act (ECOA):

A 1974 federal law found under the Consumer Credit Protection Act (Title VII), requiring fairness and impartiality with no form of discrimination on the basis of color, race, religion, sex, national origin, or marital status.

It ensures that customers and businesses have equal chances to get credit as long as they meet all the legitimate and legal underwriting guidelines. Different agencies are in charge of enforcing this law, depending on the credit grantor’s identity.

A private individual who faces such violations may bring a private or class-action lawsuit against an offender.

47. Equity:

The difference between a real property’s value and the amount of the mortgage debt on it. For example, if you owe $50,000 on your home but its total worth is $150,000, it means you have an equity of $100,000.

Under federal law, private mortgage insurance should be canceled automatically (if it was already in place) when a person’s equity in the property gets to 22% of the value of the real property (that is, the mortgage is reduced to 78% of the value of the real property).

48. Escrow:

The process in which a disinterested third party (called an escrow agent) holds money or documents in trust for the purpose of consummating the instructions of the concerned parties as written in their contracts.

Usually, an escrow agreement contains a clause that allows the escrow company to pay all the money in its possession into court (this action is referred to as an interpleader) if the parties have a dispute that they are unable to resolve.

Furthermore, the escrow company will name the parties in dispute as defendants, disclaim any of its interest in the said property apart from the reimbursement for expenses of bringing the action to court, and allow them to resolve their differences in court. By doing so, the escrow company will avoid liability and take itself out of any dispute.

49. Estoppel:

A doctrine that prevents a person from taking a course of action or denying facts because it wouldn’t be fair under particular circumstances. It could be as a result of some other person relying on past statements of fact or relying on a situation that a party allowed to exist but the said party can no longer change the situation.

Tenants usually sign estoppel certificates before the sale of a property that will yield income to acknowledge that they have no claims or defenses against the landlord.

50. Exclusive Agency Listing:

A relationship in which a real estate broker reserves the exclusive right to list a property and get a commission. Under this listing agreement, a listing broker acts as an exclusive real estate agent for the purpose of helping a property owner to sell the property.

If, however, the property owner finds the buyer instead, the listing broker may be paid no commission or a reduced commission at most. A listing agreement like this can give the property owner limited options of real estate brokerage services instead of the regular full range.

If, however, a selling broker (a second real estate broker) finds a buyer for the property instead, this selling broker will receive some commission.

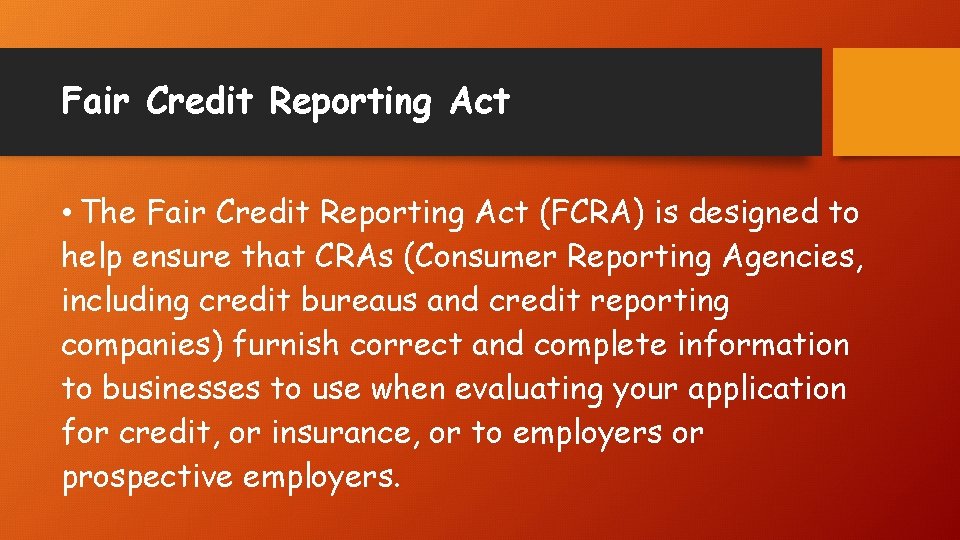

51. Fair Credit Reporting Act (FCRA):

A federal law put in place and enforced by the Federal Trade Commission to remedy abuses from credit bureaus and other credit reporting agencies, lenders and businesses that get reports from credit bureaus, and parties furnishing consumer information to credit bureaus.

The law does not permit reporting any credit information that is erroneous or outdated. Examples of adverse information that cannot be reported include paid tax liens of over seven years, civil judgments or suits older than ten years, and any other information older than seven years, except crimes.

(Source: Slidetodoc)

52. Fair Market Value (FMV):

The amount agreed upon for a property to be transferred between a willing buyer and a willing seller, both of whom know and understand all the pertinent facts and are buying or selling the property without being forced or pressurized to do so. It is also known as a market value.

The conditions for FMV are: the parties involved are not under any pressure to buy or sell, both parties are aware of all the facts, they both have ample time to decide on an amount, and they are performing the transaction in their own best interest.

53. Fixture:

A personal property that is attached (usually in a permanent manner) to real estate and now becomes a part of the real property. A fixture may be made a part of the property intentionally or designed to be adapted especially to the real property.

It is usually considered immovable since its removal could damage the real property it is attached to.

It is important to determine which object is classified as a fixture. There are guidelines to follow, some of which include, method of attachment, adaptability, intention, relationship between the buyer and seller, etc.

54. Flex Facility:

An industrial building specially designed for various uses and situated in an industrial park area. Examples of specialized flex facilities include showrooms, offices, service centers, warehouses, etc.

Sometimes referred to as a flex building or flex space, this industrial building is a speculative, often one-story, low-rise building designed for either single or multi-tenant use. It typically accommodates several offices and work areas, according to the needs of the lessee.

A flexible facility is very versatile and attracts different types of businesses including manufacturing, construction, logistical distribution, e-commerce, and medical businesses.

55. Force Majeure:

An unforeseen or unplanned event beyond the control of the parties to a contract and prevents the parties from fulfilling the terms of the contract. Examples of such disruptive events include Acts of God such as hurricanes, floods, tornadoes, etc.) or acts of man (such as terrorist attacks, strikes, wars, fires, etc.).

A force majeure can be found in construction contracts as a clause that removes liability for impacts caused by said unforeseen events and often suspends the time limits specified in the contract.

56. Foreclosure:

The process of destroying the rights of a borrower in mortgaged property. This legal process is instituted by the lien creditor or mortgagee when the borrower defaults according to the terms of the mortgage. It usually segregates into judicial and nonjudicial foreclosures, but could vary among states.

A lender can foreclose (retrieve the property from a borrower) and put the commercial property up for sale.

Avoiding a commercial real estate foreclosure will go a long way to ensuring that your credit rating does not suffer any serious hit. Some options to consider before opting for foreclosure include forbearance, loan modification, short sale, deed in lieu of foreclosure, and bankruptcy.

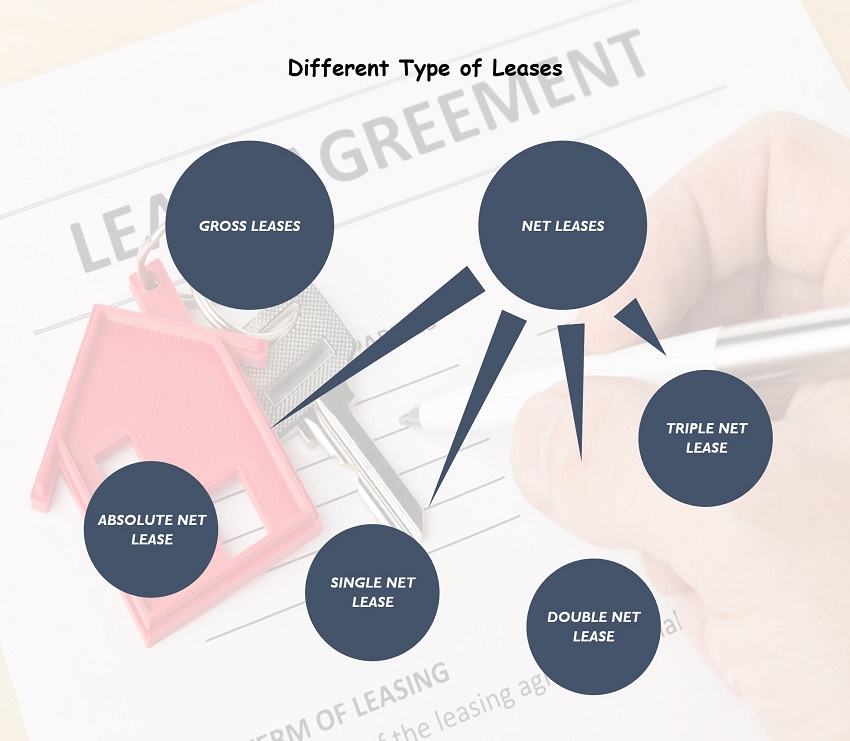

57. Gross Lease:

A commercial real estate type of lease in which a tenant pays an agreed amount of rent monthly or yearly, regardless of the operating costs of the landlord, such as taxes, maintenance, and insurance.

The tenant may consent to a ‘gross lease with stops,’ which means that the tenant has agreed to pitch in and help with payment if the operating costs of the landlord rise above a particular level.

The point at which the tenant starts contributing is referred to as the ‘stop level,’ because the landlord’s share of the costs will stop at that level.

58. Ground Lease:

A long-term land lease where the tenant can erect improvements at his or her own expense in order to gain access to valuable and well-located real estate. In some cases, the owner may not be willing to sell the property or is prohibited from selling it for a period of time.

(Source: Wall Street Mojo)

All improvements made to the property become the landowner’s property when the lease comes to an end.

Ground leases often occur between commercial landlords, who often lease land to tenants for 50 to 99 years. Such leases may not favor a landlord as they attract higher tax implications for the landlord, depending on the location of the property.

59. Ground Rent:

An amount paid for the use of land (usually on which to erect a building) even though the title to the property is being held as a leasehold estate. The borrower may have a long-term lease on the property (for as long as 90 years or more) but does not actually own it because the lessor still retains title to the land.

Ground-rent arrangements are typically used by hotels and office buildings. The tenant has to pay monthly land rents to the landlord while using the land.

Unlike ground leases that last for 10 or 15 years, ground rent is automatically renewable and continues as long as the annual ground rent fees are paid.

60. Hard Cost:

Readily identifiable construction costs, such as the site, landscape, construction management fees, labor costs and materials, safety equipment and systems, HVAC, groundskeeping, and so on. They are sometimes referred to as direct costs.

They are not as tricky and as ‘full of surprises’ as soft costs. Rather, hard costs are tangible, which makes them easier to deal with and easier to identify – especially for estimation purposes. One can easily estimate what they will be and try to find other options for reducing the costs.

61. Highest and Best Use:

When land or buildings are used in such a way that they bring in the highest possible economic return over a given financially feasible and appropriately supported period of time. This legal and reasonably probable use of an improved property or vacant land often results in the greatest financial return.

How a site is optimally used is often determined by its location, local zoning regulations, neighboring properties, and deed restrictions. Commercial property is more likely to meet its optimum economic potential.

62. Internal Rate of Return (IRR):

A percentage rate that is earned on the money remaining in an investment every year. Also, it can be seen as the annual rate of earnings on an investment which equals the value of the cash returns with cash invested, while also considering the power of compounding interest.

(Source: Dreamstime)

For income properties, the IRR can be either the interest or discount rate required to discount the total amount of future net cash flows (which may include amortization, payments of loans, and depreciation of the real property), to an amount that equals the initial equity of the said property.

Meanwhile, for development projects, IRR is defined as the interest or discount rate required to discount (or reduce or convert) the sum of all development expenditures and incomes in order to equal zero.

63. Judicial Foreclosure:

Foreclosure proceedings on real property where the mortgage does not have a “power of sale” clause. This commercial foreclosure mechanism, which some states apply, involves an action that must be filed with a court before the foreclosure process begins.

In a judicial foreclosure procedure, the lender seeks a “judgment of foreclosure” and an “order for sale” of a mortgaged property after commencing a court action against a borrower. If the court grants the order, debt fees will be fixed and the court will order for a foreclosure of the property. The lender will then be free to sell the property.

64. Jumbo Mortgage:

A loan whose amount exceeds the size limits set by the Federal Housing Finance Agency (FHFA). It cannot be guaranteed, purchased, or scrutinized by Fannie Mae or Freddie Mac. Hence, the lender’s risks are increased.

Jumbo loans are recommended when purchasing a high-priced investment property that is too expensive or beyond the limits of a conventional conforming loan.

Such a loan has to either remain in the portfolio of the lender or, as difficult as it may be, it will be sold to investors. Some banks charge higher interest rates for loans sold to investors.

65. Key Performance Indicator (KPI):

This metric is used when measuring a property’s performance. Accessing these KPIs on a daily basis will help to maximize a commercial real estate investor’s profits.

More so, tracking and exceeding the KPI targets will make an investor more proactive in keeping occupancy high, reducing vacancy, lowering expenses, and maximizing income.

The best KPIs for a commercial real estate include aged receivables, daily resident activity (including lease renewals, move-outs, and move-ins), financial statements, occupancy, prospect conversion ratios, make ready/spec suits, work orders, evictions, budget to actuals, tenant analytics, job cost, and portfolio analytics, among others.

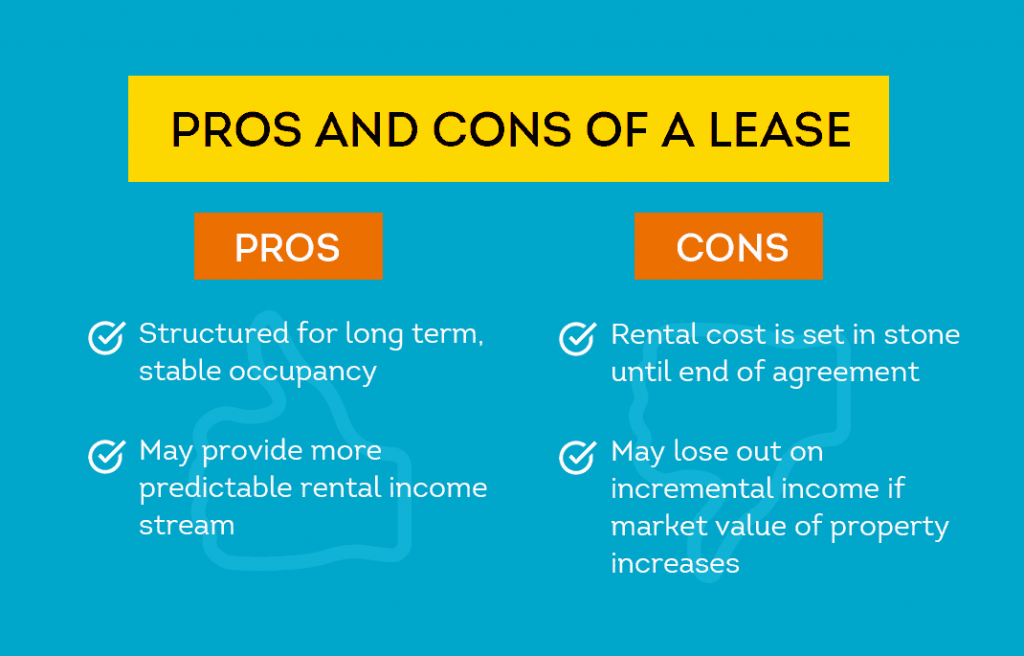

66. Lease:

A contract (in the form of either an oral or written agreement) that creates a relationship between a lessor (the landlord) and a lessee (the tenant). This contractually binding agreement grants a right to use of property or exclusive possession of the property, usually in return for a rent.

A lease must cover basics like rent or other costs, restrictions on the way the property is used, when the lease will start and when it is expected to end, how payments will be made, etc.

(Source: My Smart Move)

67. Leasehold Estate:

This form of real estate, which is more common in commercial real estate, allows a tenant to construct permanent structures on a parcel of leased land, and, during the lease period, also use or get income from the structures.

Usually, leasehold estates involve long-term leases (ranging from 20 years to 99 years) and landowners can have their property developed without spending a dime. Another benefit to landowners is that they retain their rights to the land and still get a steady stream of income from it without having to sell it.

Meanwhile, a leasehold estate allows the tenant to save the costs of initial land acquisition and gain easy access to real property that may not be available otherwise.

68. Letter of Intent (LOI):

A written document reinforcing the commitment of a tenant to lease the property. Terms of the lease that should be included in the LOI include negotiations, timeframes, and concessions. A letter of intent must be signed before a lease or purchase agreement.

A broker is responsible for evaluating an LOI, assessing the seriousness of the tenant or buyer, and making sure no stone is left unturned before closing a deal.

In some cases, more than one Letter of Intent may be necessary to make it easier to pick the most suitable tenant or buyer for a property.

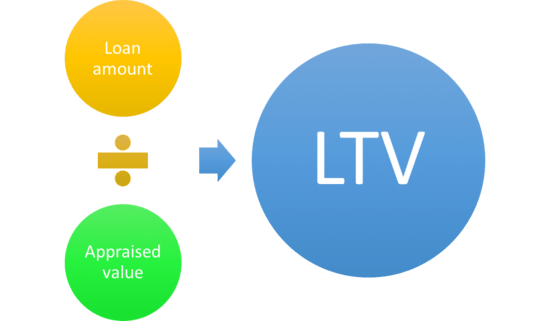

69. Loan-to-Value Ratio (L/V):

An amount of money that was borrowed based on a property’s total market value (appraised value). It also refers to the relationship between the amount taken as a loan and the value of the property (often, this property is pledged as security) expressed as a percentage of the value of the property.

The formula is expressed as the amount of loan divided by the value of the property.

(Source: The Truth about Mortgage)

LTV or L/V ratios may affect interest rates, lender requirements for both PMI and escrow accounts, and loan qualifying criteria. For example, a $100,000 commercial building with a mortgage of $80,000 has an L/V of 80%.

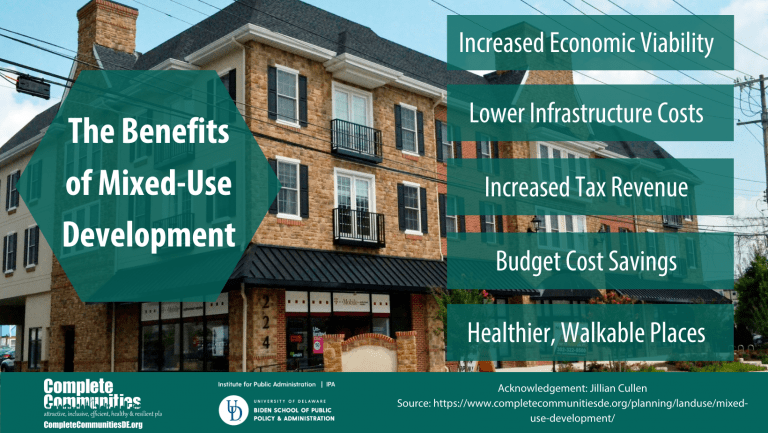

70. Master-Planned Community:

A mixed-use, large-scale real estate development following a comprehensive, long-term plan. Such communities often blend the price ranges of residential neighborhoods with a couple of commercial properties that are designed to serve the needs of the residents.

(Source: Delaware Complete Communities)

Commercial development may include retail strip centers, shopping malls, entertainment centers, restaurants, and office buildings. Multiple home builders are also included when constructing these various neighborhoods.

Meanwhile amenities like neighborhood schools, extensive landscaping, as well as public recreation centres and parks are usually offered by master-planned communities.

71. Mortgage:

A mortgage refers to a contract that provides security for a loan repayment. Before deciding on the mortgage loan, the lender (called a mortgagee) considers the property (known as the security) and the financial ability of the borrower (also known as the mortgagor; in this case, it is the covenant).

In a mortgage, the property is used as collateral and the lender will have a lien on the said property. A mortgage can also mean the amount of money borrowed with interest (the interest rate is also known as the mortgage rate) for the purpose of purchasing a property.

72. Mortgage Broker:

An individual or company that stays connected to financial institutions or individuals who are interested in investing in mortgages. A mortgage broker connects borrowers to lenders in order to originate a loan and is responsible for taking loan applications, processing loans, and even closing the loan.

A commercial real estate mortgage broker or commercial mortgage broker is a trained financial specialist with the knowledge, expertise, and connections needed to provide businesses and investors with options and services for securing a commercial mortgage.

73. Negative Amortization:

In this type of amortization, payment made is not sufficient to fund the full repayment of the loan after its due date. Usually, it occurs when unpaid interest is added to the loan balance and payments do not cover the interest due. In such a case, the amount that should be paid will be added to the remaining balance that the defaulter owes.

This remaining balance may increase instead of decrease over the duration of the loan. A negative amortization typically happens when a ceiling limits the increase in the monthly payment.

74. Net Lease:

A commercial real estate lease in which a tenant pays the stipulated rent and also pays a portion of the operating expenses including real estate taxes, maintenance costs, and insurance premiums. It is expected that all expenses that the tenant should pay directly should be disclosed.

(Source: Outsourcing Hub India)

If the landlord passes on three operating costs namely, taxes, insurance, and maintenance, to the tenant, the arrangement will be referred to as a “triple net lease.” A net lease is always in the landlord’s favor because the operating costs are variable and rarely decrease.

However, a tenant may bargain for a net lease that has caps or ceilings, as this can limit the rent the tenant is supposed to pay. An example of such protection is when a net lease with caps specifies that if taxes increase beyond a certain point or if new taxes come up, the landlord will have to pay it.

75. Net Listing:

Net listing is an expressly agreed-upon price, below which an owner will not agree to sell the property. If the property is sold at exactly the exact net listing price, the broker will not get a commission because a broker’s commission is the excess amount on the net listing price.

In this type of listing, the broker’s interests are somewhat at odds with the seller’s interests, hence, the broker may not be able to fully maintain fiduciary responsibilities to the seller.

76. Net Operating Income (NOI):

A potential rental income in addition to other income, credit losses, operating expenses, and less vacancy. NOI is generated before deducting financing expenses and taxes, and after deducting operating expenses.

Net operating income in commercial real estate is a measure of the income stream of an investment property. It helps to assess the potential returns as well as cash flow of a property. Also, it does not include any financing and tax costs incurred by the investor or owner, but remains unique to the real property.

To measure NOI, deduct the operating expenses from the property’s gross income.

77. Office Property:

A type of commercial property, typically housing management and staff operations, used for maintaining or occupying professional or business offices. The word ‘office’ may refer to whole buildings, office parks, floors, and parts of floors.

An office space is referred to as a generic office space it is used for a wide variety of purposes. Usually, office properties fall under three classes – A, B, and C. Class A office properties are very modern in their functionalities, while Classes B and C properties are older, require modernization, and often attract lower rents.

Properties classed B and C are not always as desirable or as efficient as properties in Class A because their condition or design are prone to functional problems.

78. Oversupply:

Oversupply, in commercial real estate, is the stock of supply of a particular type of commercial property that exceeds the quantity that can be cleared under prevailing market conditions and prices levels.

It could also refer to a real estate market cycle phase or period when commercial real estate markets are saturated with units as a result of overbuilding.

Simply put, oversupply means that the property on the market is too much compared to the demand. For commercial property buyers, it means there are too many properties for sale relative to the demand from purchasers.

79. Planned Unit Development (PUD):

Referred to as Planned Commercial Development (PCD) in commercial real estate, it is a situation where the planned unit development association owns and maintains any real property in a real property development project for its members who belong to the association by reason of the ownership and own individual parcels of property in the development.

Each owner has a title to a particular parcel of land, hence lenders can decide to treat units as non-condominiums if the fees and level of services are similar to those of a condominium complex. A PUD allows higher LTV loans while eliminating requirements for owner occupancy percentage.

80. Power Center:

A retail center that is dominated by many large anchors, such as discount department stores, warehouse clubs, or off-price stores that offer a wide range of selections in a specific merchandise category at reduced prices.

Power centers are outdoor shopping centers often located in suburban areas because of cost and space restrictions, but they are sometimes located in urban areas too.

Usually, a power center comprises several free-standing or unconnected multiple smaller anchor tenants like pharmacies and grocery stores, and just a few small specialty tenants.

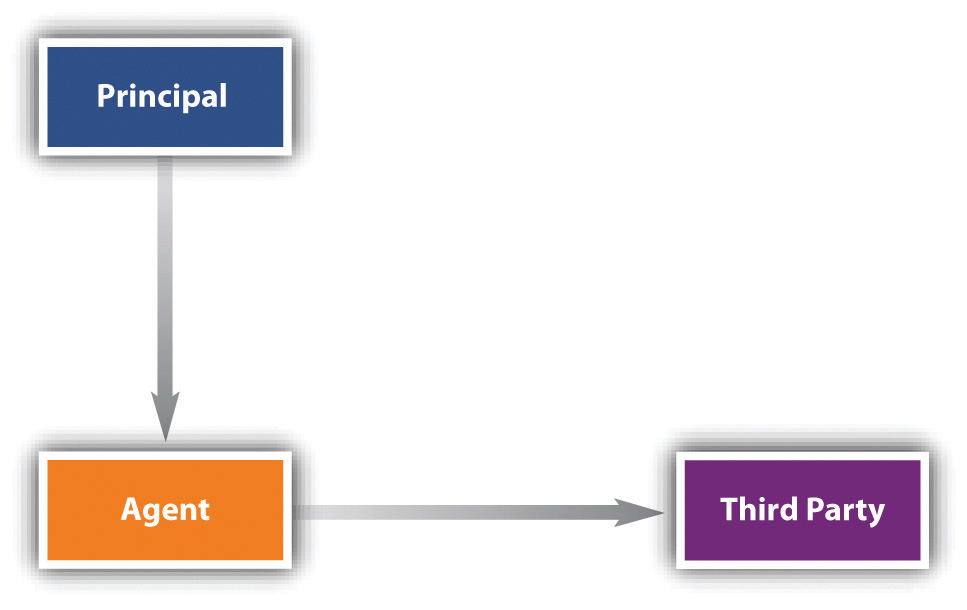

81. Principal:

A principal can refer to someone who authorizes a real estate agent to act or create legal relationships with an interested third party.

(Source: Lard Bucket)

A principal can also mean a portion of a loan payment usually used to reduce the original amount of the loan. This amount of money has not been repaid to the lender yet and does not include interest the borrower needs to pay before borrowing the money.

The principal balance (also referred to as unpaid principal balance or the outstanding principal balance) is obtained by subtracting the amount of money repaid from the amount owed on the loan.

82. Qualify:

To meet the requirements for approval set by a mortgage lender. It is usually the first out of a four-stage process of transaction management involving the gathering of information, and then evaluating the information to measure the willingness, readiness, and ability of a client to consummate the transaction.

Before qualifying a prospect, it is important to look out for certain attributes. First, the prospect must need commercial real estate services. Secondly, he knows that he needs the services. Thirdly, the prospect should have the authority to act on this need as well as the budget to back up the authority. Lastly, he should also trust you enough to willingly follow your guidance.

83. Quality Control:

A system put in place to safeguard whoever is giving out a loan and makes sure the loan goes through the right process of being originated, underwritten, and then serviced in accordance to the standards of the lender, investor, mortgage insurer, or government insurer. This system safeguards the person

84. Real Estate:

Land and permanent improvements attached to it (either natural or man-made), as well as the right to own them and also use them. It is also referred to as realty or real property.

It is a form of real property that differs from personal property. Categories of real estate include residential, commercial, raw land, industrial, and special use real estate.

(Source: Real Estate Skills)

Investing in real estate can be done directly (by purchasing a real property) or indirectly (through a real estate investment trust).

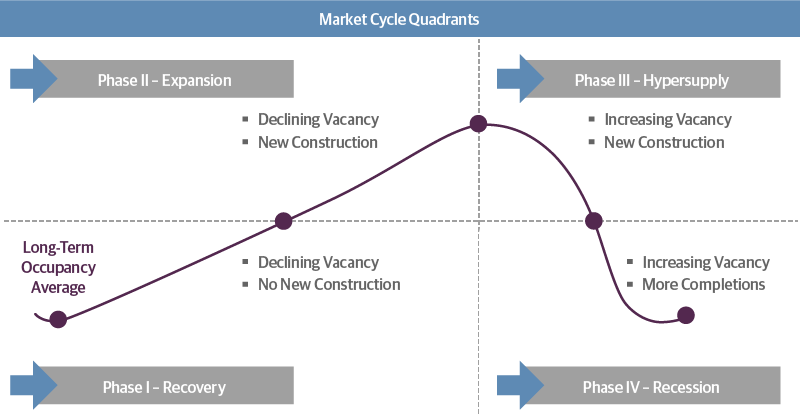

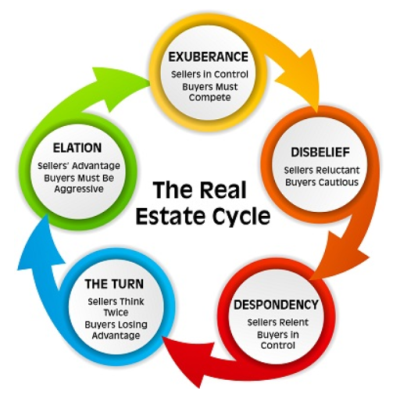

85. Real Estate Cycles/Phases:

The sequence of economic upturns and downturns that repeat regularly, as well as related changes in real estate market transactions linked to changing macroeconomic conditions and market dynamics, with phases comprising recovery, expansion, oversupply/hyper supply, and recession – in this order.

(Source: Guggenheim Investments)

Understanding the real estate cycle is important for predicting upcoming trends, which will help to make informed investment decisions.

Demographics, interest rates, government policies, and general economy are some of the factors that can affect real estate market cycles.

(Source: Medium)

86. Rentable Area:

It comprises a building’s computed area, in accordance with the Building Owners and Managers Association (BOMA) guidelines, and includes both the structure or core of a building and its usable area. It is this actual square foot area that the tenant will pay rent for.

The rentable area includes common areas like lobbies, hallways, restrooms, architectural projections, and measurement of structural columns.

Generally, a rentable area is bigger than a usable area and commercial property landlords base their rents and expenses charges on the size of this area.

87. Right of First Refusal:

In an agreement, this provision requires that the owner of the property gives someone the first opportunity to lease or purchase the said property before offering it for lease or sale to other interested parties. The person is under no obligation to take the property.

Also known as the first right of refusal, the right of first refusal is a tenant’s negotiated right in a commercial lease meant to match any offer by a landlord to lease premises. However, it could limit the amount an owner may receive from other parties competing for the real property.

Usually, individuals or companies who are eager to see how a business, opportunity, or property turns out will request rights of first refusal.

88. Servicer:

A firm specialized in performing special servicing functions, such as collecting and remitting mortgage payments, paying the taxes of a borrower, administering escrow, sending notices and statements to the borrower and lender, and managing delinquency.

A loan servicer helps to collect and handle the daily tasks involved in collecting a mortgage loan.

These servicers may work with borrowers, who have defaulted on a loan agreement or fallen behind on payments to determine the most favorable outcome for the borrower and lender, as well as look for alternatives to foreclosure.

89. Settlement:

In a commercial property settlement, ownership of the commercial property is transferred from the seller to the buyer.

It is a process whereby a loan transaction is completed, mortgage documents are signed, checked, and recorded, and the balance of the real property’s purchase price is paid, and both parties’ agents inform them that the settlement is complete.

After these processes, the property is then transferred to the buyer. Some jurisdictions refer to this as closing, while others refer to it as an escrow.

90. Sublease:

A type of lease whereby an original tenant (also called the lessee) sublets a part or all of the leasehold interest to a different tenant (called a subtenant or sublessee) without losing a leasehold interest in the property.

A sublease is also referred to as a sandwich lease because the original lessee is sandwiched between the lessor and subtenant. In this kind of rental agreement, the rent is paid to the tenant who is fully responsible to the landlord for rent and any damage, including those caused by the sublessee.

(Source: AHPM)

Most landlords will only allow subleases when they have already given prior written consent.

91. Trade Area:

An area that has been delineated about a dominant or central location. It is made up of a zone that depends on the production output from the location to meet internal demand. The outermost boundaries of the zone are defined by the presence or absence of interactions involving the central or dominant location.

Trade areas are often based on retail areas, which provide convenience and synergy for future customers. To maximize the value position, it is important for an investor to find optimal trade area characteristics that are specific to his business model.

92. Timeshare:

Primarily used when selling vacation properties, timeshare is an arrangement whereby a purchaser gets an interest in real property along with the right to use the accommodation and/or its amenities on a recurring basis and for an agreed period of time.

This shared ownership model allows multiple purchasers to own allotments of usage in the same property. Vacation properties that allow the timeshare model are vacation resorts, campgrounds, apartments, and condominiums. Use of the vacation property is limited to a season or period of time – sometimes a fixed week or a floating week.

93. Title:

The right to a property and its ownership. A title, which is sometimes referred to as a deed, can be used in some cases as proof of ownership of land.

Deeds may convey title between a buyer and a seller, but not all deeds can convey full ownership of a commercial real estate property.

A commercial real estate investment may be worthless if a prospective owner does not acquire a good title. More so, a single document does not determine the title to real estate; rather, an entire collection of documents affecting a certain property will determine the title to real estate.

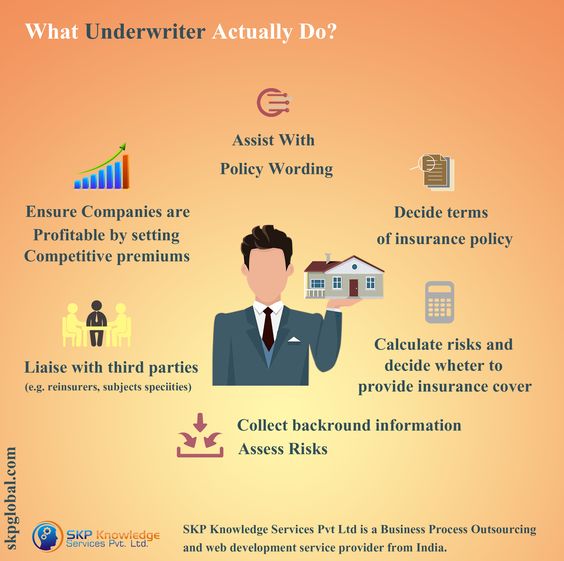

94. Underwriting:

A process that helps to determine the approval of a loan. It mainly involves an evaluation of the property, the borrower’s credit, and the ability of the borrower to pay the mortgage. Lenders use underwriting to determine a potential customer’s creditworthiness.

An underwriter makes sure applicants are representing themselves truthfully, no one else is on the title and there are no dangers to the property caused by natural disasters. It is also the work of an underwriter to determine if the sale price of the property meets its appraised value.

(Source: SKP Global)

95. Usable Area:

A usable area is an actual space a tenant occupies from wall to wall. In other words, it is the area a tenant would get if the offices or warehouses are paced out. It is generally not as big as a rentable area.

The usable area of an office building is the area available for the tenant to use exclusively. It may include corridors, bathrooms, and storage facilities.

If a tenant leases several floors, the usable area will include hallways but exclude linked areas such as changing rooms.

The formula for calculating usable area is given as: Usable area = Rentable area x Building efficiency percentage.

96. Vacancy:

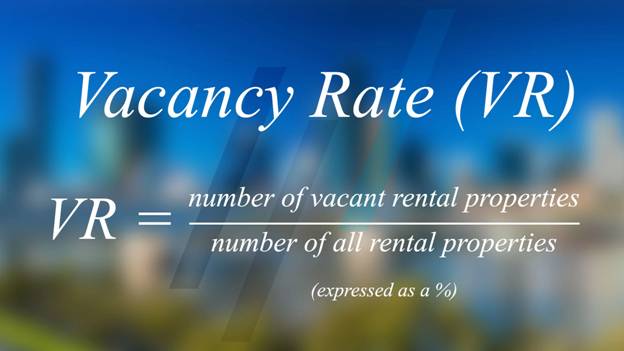

The number of vacant units or space in a particular commercial type of building that is available for occupancy within a given market at a certain time.

(Source: Performance Data)

A vacancy rate, defined as the percentage of the total units in a single, uninhabited rental property during a specified period of time, serves as a pointer to assess the overall performance of a property relative to the average vacancy rate of other commercial properties in the area.

A property with a high vacancy rate is considered undesirable, while a low vacancy rate is a positive indication that people are interested in investing in that property.

97. Walk-Through:

A clause used in a sales contract that allows a buyer to examine a property within 24 hours before it is purchased or before closing. In other words, it is a buyer’s on-site inspection of a property that is being purchased, prior to closing.

A walk-through could also mean a detailed inspection of a brand new construction home, allowing a punch list and cosmetic items to be addressed before final acceptance.

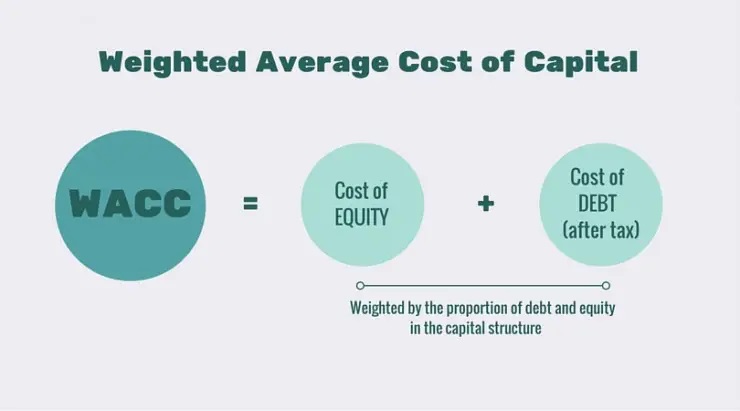

98. Weighted Average Cost of Capital (WACC):

It is the average cost of capital for either equity or debt used to finance a commercial real estate investment, giving consideration to the relative proportions of each capital source.

It is also defined as the return on the total capital that is required to meet an investor’s goals.

(Source: Cleverism)

WACC helps to determine an investment’s hurdle rate as well as the discount rate for a company’s valuation. Hence, it is important for every listed property company to identify its specific WACC.

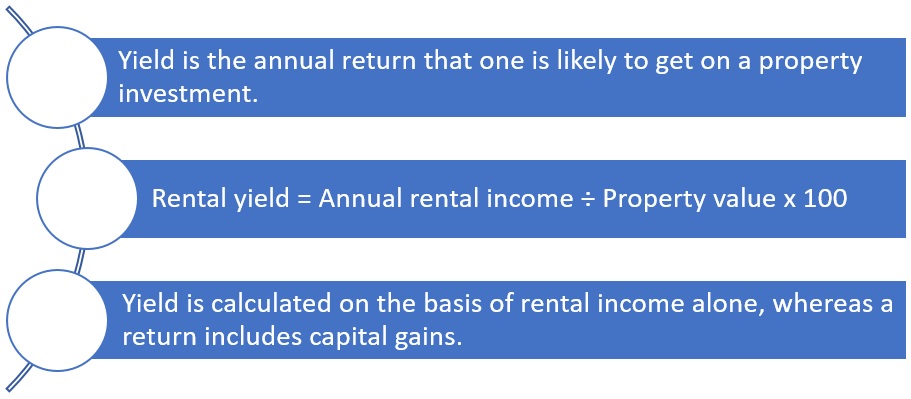

99. Yield:

Sometimes referred to as the rate of return, yield is a measure of how an investment (for example, commercial building) is performing. It weighs the percentage return on the money invested.

(Source: Housing.com)

Also, yield is the annual income obtained from an investment and expressed as a percentage of the total cost of the investment (in some cases, its estimated current value).

Yield is mainly a measure of income produced by a commercial property without factoring in appreciation or increases in its value.

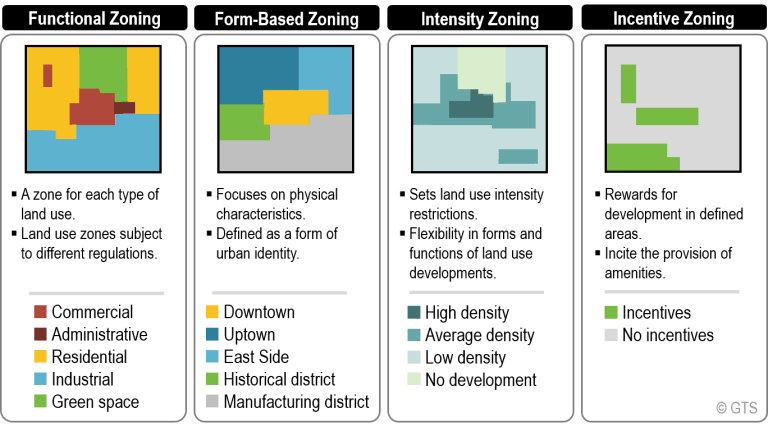

100. Zoning:

A designation of some particular areas by the local planning authority with a jurisdiction meant to legally define the land use or categories of land use. It ensures that municipalities achieve a layout they feel is best suited for their area.

Zoning laws are crucial to the utilization of land and buildings in cities or towns. Types of zoning include residential, commercial, agricultural, industrial, historical, recreational, aesthetic, etc. Each type of zoning helps to accomplish different results and has varying rules affecting how each parcel of land can be used.

(Source: Transport Geography)

And It’s A Wrap!

We hope you found our commercial real estate glossary helpful. We believe it is one of the best commercial real estate resources on the market and use it plenty ourselves!

If you need more information about any of the commercial real estate terms provided in this guide and their implication in practice, do not hesitate to contact us.

At Commercial Consult, we can help you sell your commercial property with less stress while ensuring that you get all you want out of your deal. Our trusted advisors are waiting to hear from you.

3100

Bristol

St., Suite 150,

3100

Bristol

St., Suite 150, info@commercialconsult.com

info@commercialconsult.com