How To Control Legal Costs In Commercial Real Estate Transactions

Commercial property is defined as a building used exclusively for business or a workspace rather than a residence, considered residential real estate. Commercial real estate is often leased to tenants to conduct income-generating activities. Common real estate transactions in commercial real estate include leasing office space, building new office buildings, and selling company-owned land. It does not matter if the property in question is an office or a factory; commercial real estate is all the same. Commercial real estate is typically the result of a business transaction.

A Practical Guide to Commercial Real Estate Transactions

Commercial real estate transactions are complex, multi-step processes that can take months to complete. Learning about the CRE transactions process has three major benefits for investors:

1) Determine the level of uncertainty throughout the transaction process and how execution risk diminishes as the transaction proceeds

2) Recognizing sponsors’ expertise

3) Gaining a better understanding of the level of work involved in bringing deals to investors.

Here is a practical guide to commercial real estate transactions:

Assessing Investment Opportunities

The U.S. commercial real estate market is worth multi-trillions of dollars. As such, sponsors are presented with various investment opportunities, ranging from purchasing a high-rise office tower in New York City to acquiring a shopping center anchored by a grocery store in Des Moines. They must develop a strategy for differentiating themselves.

Developing an investment thesis is the first step. Sponsors determine which investments they will pursue based on their experience and research, including asset types, asset classes, risk profiles, and geographical locations. In many cases, the result of this analysis comes down to the intersection of what types of investments sponsors consider most appealing and what they are good at.

Source: Joe Fairless

Starting with the macro-level view of potential investment opportunities is the best way to identify potential investment opportunities. For some sponsors, the first step is to identify a specific market, while for others, it is to identify a real estate type. Certain sponsors, for example, specialize in a particular type of apartment building. When identifying the best locations for those properties, they use a geographical approach. Market analysis may start with a region, state, or city; it may continue with submarkets, neighborhoods, or even key streets.

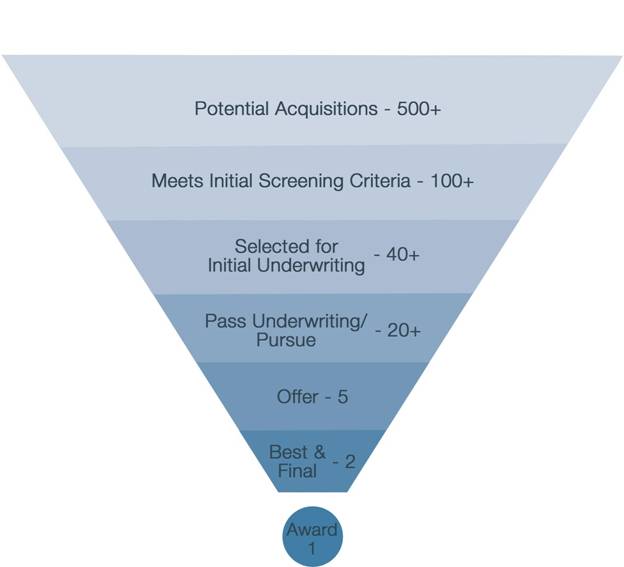

Some sponsors may already have a deep understanding of the area and instead concentrate on identifying what type of property presents the best opportunity for them at the time. Research, analysis, and market knowledge are required in both scenarios. Before choosing to move forward with a specific acquisition, sponsors may examine hundreds of potential investment opportunities, both on and off the market.

Underwriting

Underwriting involves a detailed financial analysis of the current occupancy, rental income, property taxes, and utilities, as well as assumptions for future performance. Sponsors ask a host of questions

- What is the real reason behind the seller’s decision to sell this property? Why do they feel the need to sell?

- Is it possible to increase rents that much?

- Over the holding period, what might the occupancy be? Is the demand for the foreseeable future outpacing the supply?

- Is there a capital cost associated with deferred maintenance and improving the asset?

- How relevant or irrelevant is this location becoming? Is that likely to change?

- How can we exit at our target value and still leave some meat on the bone for the next buyer?

Source: New Wave Capital

They will then use their expertise to construct a pro forma analysis that incorporates defensive assumptions to calculate return levels acceptable for a potential acquisition. In this case, the price is deduced based simply on assumptions and parameters that determine return thresholds. In most cases, sponsors will complete multiple underwritings to evaluate the upsides and downsides of the investment. This allows them to determine whether the investment will be worth taking on the associated risk. Last but not least, underwriting is a dynamic process where the sponsor continues to gather research and learn new information, which then determines the analysis, underwritten returns, and corresponding pricing.

A Crack at the Deal

The acquisitions team will ramp up its efforts or, in industry-speak, make a run at the deal if the initial underwriting process results in an asset that appears attractive from a fundamental perspective and can be put in place at a price that appears competitive. Specifically, the acquisitions team will:

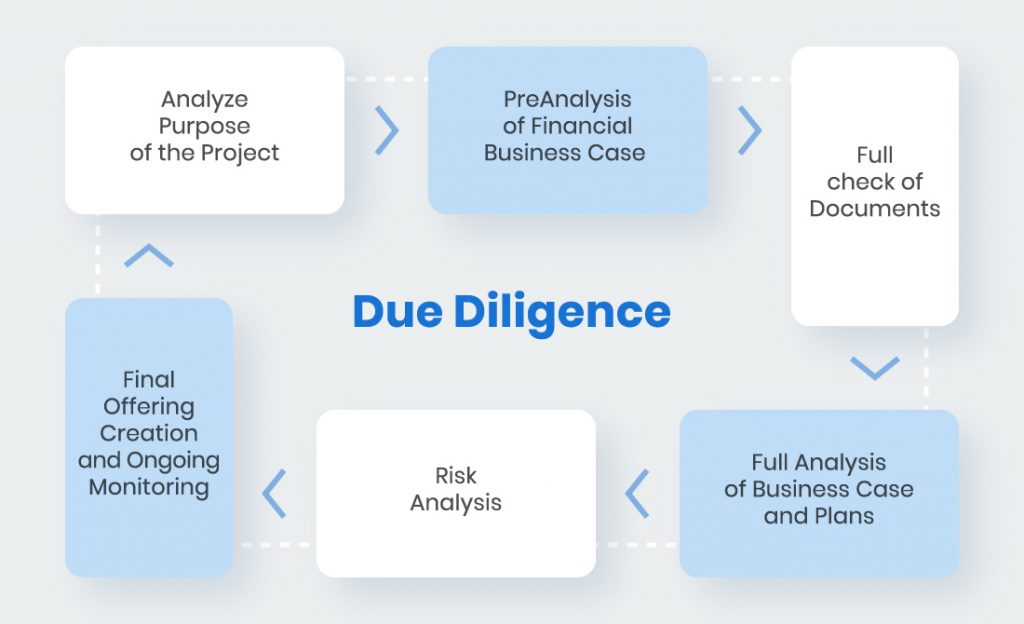

Due Diligence Preliminary

By leveraging every resource available to it, the sponsor can learn as much as possible about the asset as quickly as possible, without incurring substantial costs for hard diligence. During this time, you will see sponsors investing in the due diligence process of third parties (particularly if they are aggressively targeting a deal).

In the case of an on-market or off-market deal, indicate the buyer’s interest in the deal to the seller’s representative or the buyer (in the latter case only).

In this phase, buyers begin posing as ideal buyers. When assessing buyers, sellers look for the certainty of execution. Hence, while the price is vitally important, it is often not as crucial as being confident that the buyer you select will close the deal at or near the agreed price. The more assurance buyers can convey, the better price they can ultimately achieve. This is because buyers play into sellers’ desire for certainty of execution.

Source: Deal Room

Tour the property

Without touring the property, brokers and sellers will not take bidders seriously.

Get in Touch with Submarket Leasing Brokers

Buyers must talk to submarket leasing brokers as this is the best way to obtain an independent view of the potential for the asset to attract tenants and at what rental rates. Brokers leasing submarket assets have typically leased nearby properties for years, if not decades. Thus, they often have a deep understanding of the property. To learn as much as possible about an asset in a short time, leasing brokers provide an outstanding resource to buyers.

Tour the Competitive Set

Having gathered intelligence from trusted leasing brokers, investors will tour the properties that compete with the subject asset. In the process of gaining comfort that a property the buyer is targeting is as attractive as their desk analysis suggested, walking those properties with the perspective of a potential tenant is a key step.

Bidding in the First Round

As soon as all the pieces come together, buyers present their initial bids, typically framed as letters of intent.

The Award of Assets

The chase begins as soon as the first round of buyers’ bids is submitted. The buyer’s goal is to win the deal at the lowest price and the best terms.

To identify the best candidate, sellers want to play buyers off of one another to find the one that can close at the highest price. It is a bit like playing chess in these situations. In addition to competing for market share, buyers also strive to maintain pricing power. It is in the sellers’ interest to pull buyers up in price. Still, they also know that the likelihood of having the most qualified buyer drop out increases with every dollar extracted, and they may end up with a buyer who substantially retrades the property after conducting due diligence in commercial real transactions.

Bids in the First Round

At this point, sponsors work closely with the seller’s representatives to become the winning bidder in an intense negotiating process. In this stage, buyers need two things:

1) a competitive bid that will keep them in the game and allow them to go on to the next round and

2) a good relationship with the seller’s representatives to understand what it takes to remain competitive. During the first round, a buyer’s main objective is to gain admission to the next round, known as “Best and Final.”

Best and Final

At this point, the field is whittled down from approximately 20 to 30 initial bidders to 3 to 5 qualified bidders. As buyers begin to feel a sense of accomplishment, the intensity increases in an attempt to differentiate themselves from the small group of bidders remaining. During this stage, sellers expect all bidders to raise their prices while whispering to their two favorites that they’re interested in them to meet the desired price. In most cases, Best and Final bidders also gain an insight into their competitors. When they meet the seller’s asking price, the strongest buyers know they are overpaying, so they are reluctant to lower the price. Weaker players know they won’t win unless they pay more, so they’re likely to stretch to the desired number. With lower prices, sellers have bidders they are more capable of trusting, and at higher prices, they have bidders they are less capable of trusting. A buyer interview is typically where this situation is sorted out.

Interview with the Buyers

As discussed above, two bidders typically remain in the running and may differ in price and execution capability. After this interview, the seller’s representatives question the two remaining buyers on everything from their due diligence progress to their capital stack (including debt and equity), as well as their feelings about re-trading the seller on price following due diligence in commercial real estate transactions. There are two things the seller wants to find out: whether the buyer is less than committed to closing at the current price.

A buyer’s interview involves doing everything they can to convince the seller’s representative that the piece of property will be their next strategic acquisition or, if they are selected, a “done deal.” Their answers should counter the hard-hitting questions of the broker or intermediary with an assurance of closeness. Following this process, the seller selects a buyer, typically based on recommendations from her representatives, which is the point at which the deal is awarded.

Source: LinkedIn

A Time-consuming and Inefficient Process

Preliminary steps such as identifying, underwriting, and placing an asset under contract are often lengthy and labor-intensive. Moreover, there is no guarantee that a sponsor will ultimately win the auction. Lastly, keep in mind that this is inherently complex and inefficient. It is necessary to deal with highly qualified, experienced sponsors able to win deals at superior terms than your less experienced competitors due to the complexity of lining up commercial real estate offerings.

A quick rundown of the transaction process shows that in the processing and the workings of any CRE transactions, you can make it much easier by hiring two people – a real estate agent and an attorney.

What Does a Commercial Real Estate Lawyer Do

You might have been asking, what does a commercial real estate lawyer do?. Here is a detailed explanation of the role of an attorney in CRE transactions.

A real estate attorney’s role is to prepare and review documents about purchase agreements, mortgage agreements, title agreements, and other documents associated with real estate transactions.

A real estate attorney will attend the closing with a buyer to handle the transaction whenever possible. Closings are when the money is handed over, and the title is given. The lawyer’s job is to ensure the transfer is legally binding and in the client’s best interests.

The real estate attorney and staff assist in purchasing a property by creating documents, writing title insurance policies, conducting title searches on the property, and handling the transfer of funds for the purchase.

In the event of a real estate dispute, such as a chain of a title dispute, a lot of line dispute, or another contract dispute, the attorney will resolve the matter.

A real estate lawyer may also represent either the buyer or seller if they have to go to court to resolve a dispute. Obtaining facts from both sides of a dispute and trying to resolve them are the real estate attorney’s functions. You may need to hire a surveyor or title company to work through the details.

How To Control Legal Costs In Commercial Real Estate Transactions

In commercial real estate, clients frequently complain about legal bills because of the high hourly rate and because the work took too long. The power of multiplication is certainly evident here.

A client can bid on certain work and then hire the lowest bidder to save money. Unfortunately, this rarely works out for the client. An individual client may prefer to hire the best lawyer regardless of his hourly rate and then manage legal time and the bill. Listed below are 12 suggestions.

-

Prioritize Your Business Deals

Before involving counsel, decide on the business deal. For example, creating a nonbinding term sheet that covers the important bases: economic terms and anything else (which isn’t 100% “standard”) is important enough that it wouldn’t be done if it weren’t included in the deal.

Most of the time, if the basic economic terms have been resolved, but the term sheet hasn’t been finalized, it is best to involve counsel. At that point, the council can help identify issues that would cause legal fees if not dealt with in the term sheet and left to the definitive documents. First, the legal challenge will ensure that the term sheet does not bind anyone.

-

Gating Issues

It would be best if you resisted the urge to put off any major issue in a deal until later. Things won’t get easier later. You stand at the risk of increased real estate legal costs-fcls later on by doing so. A ground lease for a development project, for example, is usually affected by future rent adjustments and the requirement for credit support on the part of the developer to ensure the project will complete and be paid for. Before pursuing legal action, you should resolve those issues.

It would help determine the exact meaning of the non-recourse clauses in a mortgage loan before the lender starts any legal work. Refer to “carve-outs” in terms of standards rather than just “the standard.” Standard is subjective.

-

Organize Your Information

A history, context, and previous documents are presented first in most transactions.

Over time, the attorneys may spend more time organizing and tracking the information-and, determining what they have already seen and thought about and what they still need than actually understanding it and making a decision as a result. So make sure you provide all the relevant information in an organized manner.

-

Don’t Overcomplicate Things

Make sure your deal is as simple as possible. Complicated deals require more legal work and are more likely to lead to mistakes. Avoid deal elements that tend to become complicated, such as profit participation, rights of first offer or refusal, particular provisions for crazy hypothetical scenarios, and deal structures. A deal can have multiple interacting waterfalls, multiple exceptions, several alternatives, new ways of doing things that everyone else has done the same way, and so on. This is especially true for deal elements that will probably never be activated and have only limited economic or practical value.

-

Observe the Timing

Avoid emergencies as much as possible. It is more expensive. On the other hand, try not to have unreasonable timelines to complete a deal. Stick to the schedule you set.

-

Plan Ahead to Avoid Surprises

Make sure you know what you are selling before selling real estate, so you don’t run into any unexpected issues. It would help if you carried out the same due diligence a buyer would. This is due diligence in commercial real estate transactions. Consider all your needs when leasing space, not just the obvious ones. Be careful when engaging a broker that you do not already have similar obligations to another broker you hired in the past. Line up approvals early in the process if you don’t have an automatic approval process. Be sure to identify all parties involved from the start, including other parties to the transaction, such as consultants and investors.

-

Changes to the Agreement

Do your best not to alter the deal once counsel has been engaged, especially when counsel has prepared documents. Doing so increases real estate legal costs-fcls and increases the probability of mistakes and problems.

-

Size of the Document

The documents involved in most commercial real estate transactions always seem to grow longer and more complex as time passes. You could start over, cleaning your documents up to and reducing them to what is essential without covering every possibility at extraordinary length or asking the same question more than once, probably in the same way. It may be more difficult to create shorter documents in the beginning. Still, it may benefit from reducing negotiation time and revisions, which is a major source of real estate legal cost-fcls.

-

A First Draft

Rather than the more typical one-sided documents, it may make more sense to have counsel prepare and forward “reasonable” first drafts. However, it always seems as though any attorney who receives a substantial document will have a lot of comments on it, regardless of how reasonable that document is, so you might as well start from a better place. A judgment is made after considering factors such as taste, experience, context, and the cast of characters.

-

Close the Issue

You should resolve issues in negotiations rather than leaving them open. Don’t hesitate to compromise if you must. See if you can trade it for something. However, don’t let the situation fester. The legal attention and fees it requires to keep it open will continue as long as it remains open.

-

Listen and Watch

Observe what the attorneys are doing and how they are approaching their cases. Allowing them to do whatever they feel like doing is not smart. Stop them if they are overthinking or overcomplicating something. Stop them if they do something you don’t think they need to. Please don’t wait until you get the bill before stopping them. If you wait until then, your options may be limited.

-

Final Remarks

Whenever possible, do not allow attorneys to prepare closing statements, i.e., financial calculations for the closing. Attorneys are not very good at this kind of work. Lawyers charge more than just about anyone else who might do it for you. Then they wouldn’t be able to do any legal work if they had to work on a closing statement.

-

Ride One Horse

When you work with the same attorney for similar deals, they will know how you structure your transactions, what matters most to you, what doesn’t, how your business operates, who handles what within your team, and how you want to resolve matters. That is an educational process. It requires time, and it requires multiple deals.

Likely, a continuous flow of the same type of deal to the same counsel will produce greater efficiency, reduce the number of phone calls necessary to discuss issues, and, ultimately, warrant a discount on the hourly rate.

Can the Way Commercial Property is Acquired Affect its Value?

Commercial real estate transactions can be influenced significantly by the method used to acquire property ownership. In addition, your business set up before purchasing a property could have a significant impact down the road.

As a business owner, if your business assets/liabilities aren’t divided between your personal and business assets, you are exposed to a greater level of commercial risk. We can help you reduce your risk with commercial real estate transactions(CRE transactions) by using an experienced commercial real estate legal team.

What Are the Differences Between Commercial and Residential Real Estate Transactions?

Despite the general concept of paying money for the property being the same, commercial and residential real estate transactions have some slight yet important differences.

A significant difference between commercial real estate and residential real estate is the leasing of the former. As their needs change and grow, businesses tend to move from one location to another. While residential properties generally also come with leases, commercial properties generally have longer leases, around three to ten years.

It is sometimes necessary to work out a lease with the property owner with the help of counsel and mediation and a skillset our team specializes in. It is common for property owners to be real estate conglomerates that do not have the time to work closely with homeowners. Let’s break down the barriers and ensure you get the fair treatment you deserve.

In addition, commercial real estate entails several unique complications, such as how the land is zoned and what it can be used for. You need to ensure the land you intend to acquire can be used for an activity involving hazardous chemicals, such as manufacturing anything that requires the use of hazardous chemicals. It also involves a significant amount of paperwork to obtain the necessary permits.

Getting a Commercial Real Estate Contract

To acquire commercial real estate, the first step is to express formal interest in the property’s current owner. This is usually done by writing a letter of intent. Your letter should roughly state what you are looking for in a property, what kind of property you are interested in, and what kind of budget you have. The two parties will then use this to create a more formal agreement.

Essentially, legal counsel assists with the formal draft of a Commercial Real Estate contract. As a legally-binding agreement, the agreement will outline the steps the party interested in acquiring the commercial property must take to do so. Additionally, it will detail precisely what property is being transferred, such as just the building or the building and everything within it. Additional paperwork may be necessary, depending on the type of property involved.

An Agreement for Commercial Real Estate

Commercial real estate transactions can easily become overly complicated with all these factors. There are many reasons you may need the assistance of an experienced team of real estate law attorneys. Commercial real estate agreements can be a complex process that many people are unprepared for. The process is incredibly complex, and if you fail to be vigilant throughout, you might end up with a shortcoming in the end. You are guaranteed to get the best result for your business situation when you have the right attorneys at your side every step of the way.

Is Escrow Required for Commercial Property Transactions?

Even though an escrow isn’t required by law, both parties often see it as a wise decision. It relieves a lot of stress for both buyer and seller to have an escrow company on board. Many heavy processes are involved in a transaction that an escrow company manages. In addition to dealing with the paperwork, they can also provide information about the transactions. They also play a critical role in both the maintenance of records and the distribution of funds.

Is a Commercial Real Estate Agreement Still Required if an Escrow Company is Involved?

Commercial real estate agreements and escrow instructions provided by escrow companies usually serve very different purposes, so both are generally advised. The purpose of the escrow instructions is to absolve the escrow company of any liability in the event of a problem.

While the commercial real estate agreement is a personal agreement between two parties involved in the property transaction accordingly, the commercial real estate contract will generally carry more liability in the long run. In the absence of a solid Commercial real estate agreement, the following issues might arise:

- Commercial real estate transaction escrow instructions rarely communicate the true nature of each party’s accountability.

- If you buy furniture or equipment alongside commercial real estate property, your escrow instructions will not acknowledge them.

- As part of the escrow instructions, there will be no warranties or representations from either party that may be critical to the outcome of the particular commercial real estate deal.

- Generally, breaking escrow instructions does not carry the same consequences as a properly drafted Commercial real estate contract.

- In commercial real estate agreements, it is possible to stipulate that, in the event of a dispute, both parties will seek mediation and counsel before suing one another.

What Does “As Is” Mean?

It is understood that the term “as is” indicates that the property will be transferred to the buyer in its current condition, for better or for worse. Accordingly, the property is not guaranteed, promised, or warranted in any way. You can generally expect a property marked “as is” to have some fundamental flaws.

It can feel like transferring some liability from property owners when they mark their property as “as is.” Sellers should be aware, however, that some properties will not be covered by your liability if they are listed as “as is.”. These include properties in dangerous conditions, such as poorly wired electrical panels and improper disposal of hazardous waste. A legal team with experience should be consulted before trying to sell a property “as is.”

CommercialConsult

Commercial Consult can provide you with a more guided approach to controlling legal costs in commercial real estate transactions. We can also provide advice on how to get the best buyers and transact with them appropriately.

We have a team of experts with vast experience in the industry. Our commercial consultants are highly experienced in the field of commercial property. We can help you find the perfect space to meet your needs. Our expertise includes industrial warehouses, retail centers, office buildings, and more.

With the help of our team, you can acquire, lease, finance, develop, construct, and manage all aspects of real estate.

We can help you sell your warehouse or storage unit if you’re interested.

3100

Bristol

St., Suite 150,

3100

Bristol

St., Suite 150, info@commercialconsult.com

info@commercialconsult.com